Attorney-Verified West Virginia Articles of Incorporation Template

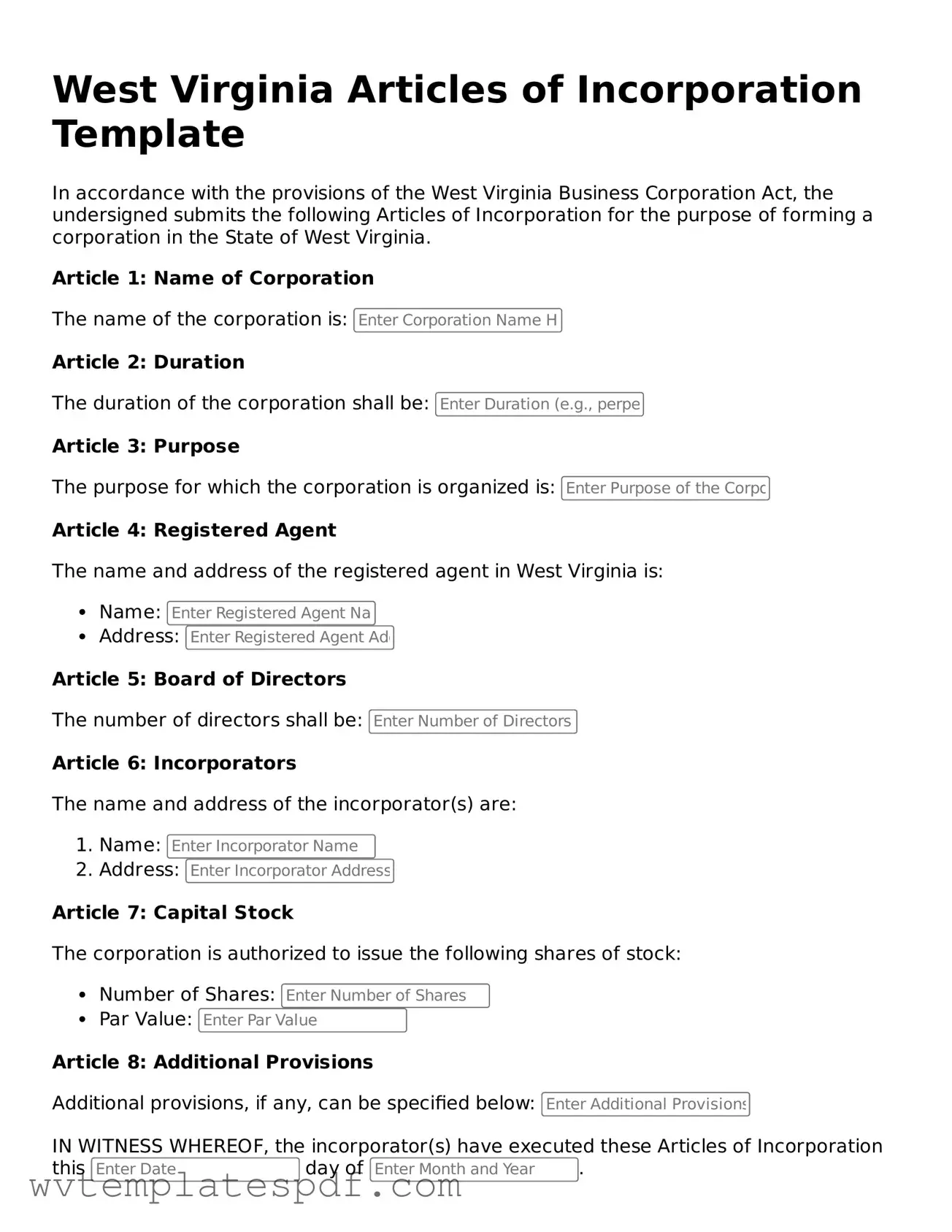

When starting a business in West Virginia, one of the essential steps is to complete the Articles of Incorporation form. This document serves as the foundation for establishing a corporation in the state. It outlines key information such as the corporation's name, its purpose, and the address of its principal office. Additionally, the form requires details about the registered agent, who will be responsible for receiving legal documents on behalf of the corporation. Shareholder information, including the number of shares the corporation is authorized to issue, must also be provided. Furthermore, the Articles of Incorporation may include provisions related to the management structure and any limitations on the powers of the corporation. By carefully filling out this form, business owners can ensure compliance with state laws and set the stage for a successful venture.

Some Other West Virginia Forms

How to Get a Lost Car Title - A Trailer Bill of Sale protects the seller from future liabilities associated with the trailer.

West Virginia Premarital Contract - This agreement can be tailored to each couple's unique financial situation.

The Arizona Residential Lease Agreement is a legal document that outlines the terms and conditions between a landlord and tenant for renting residential property in Arizona. This agreement serves to protect the rights of both parties while ensuring clarity regarding rental obligations. For more resources or templates related to this agreement, you can visit Arizona PDFs, which provide valuable information for anyone involved in a rental transaction in the state.

Sell Vehicle - This document may need to be notarized in some jurisdictions to be legally binding.

Misconceptions

Misconceptions about the West Virginia Articles of Incorporation form can lead to confusion for those looking to establish a business. Here are eight common misunderstandings and clarifications regarding this important document.

- All businesses must file Articles of Incorporation. Many people believe that every type of business entity, including sole proprietorships, must file Articles of Incorporation. However, this requirement only applies to corporations. Sole proprietorships and partnerships do not need to file this document.

- Filing Articles of Incorporation guarantees business success. Some assume that simply filing the Articles of Incorporation will ensure the success of their business. In reality, while this document is essential for legal recognition, success depends on various factors, including market conditions, business strategy, and management.

- The Articles of Incorporation can be filed at any time. There is a misconception that businesses can file Articles of Incorporation whenever they choose. In fact, it is crucial to file these documents before commencing business operations to ensure legal protection and compliance.

- Only one person can be listed as the incorporator. Many individuals think that only a single person can serve as the incorporator. In West Virginia, however, multiple individuals can be listed, which may provide flexibility in management and oversight.

- Amendments to the Articles of Incorporation are unnecessary. Some believe that once the Articles of Incorporation are filed, they remain unchanged. This is misleading. If there are changes in the business structure or operations, amendments may be necessary to reflect those changes accurately.

- All information in the Articles is public. While it is true that the Articles of Incorporation are filed with the state and are generally accessible to the public, certain sensitive information may be protected or kept confidential under specific circumstances.

- Filing fees are the same for all types of corporations. A common misunderstanding is that all corporations pay the same filing fees. In reality, the fees can vary based on the type of corporation being formed, such as a non-profit versus a for-profit entity.

- The Articles of Incorporation are the only legal requirement for starting a business. Some individuals mistakenly believe that filing the Articles of Incorporation is the sole requirement for starting a business. In fact, other legal steps, such as obtaining licenses, permits, and adhering to local regulations, are also essential for compliance.

Understanding these misconceptions can help individuals navigate the process of forming a corporation in West Virginia more effectively. It is important to approach this task with accurate information and a clear understanding of the requirements involved.

West Virginia Articles of Incorporation: Usage Instruction

Once you have the West Virginia Articles of Incorporation form ready, it’s time to complete it accurately. This form is essential for establishing your corporation in the state. After filling it out, you will need to submit it along with the required filing fee to the appropriate state office.

- Begin by entering the name of your corporation at the top of the form. Ensure the name complies with West Virginia naming requirements.

- Provide the corporation's principal office address. This should be a physical location, not a P.O. Box.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the purpose of the corporation. Be clear and concise about the business activities you plan to undertake.

- Specify the number of shares the corporation is authorized to issue. Include details about the classes of shares if applicable.

- Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Check the box to indicate whether the corporation will be managed by members or managers, if applicable.

- Review the form for accuracy. Make sure all information is complete and correct.

- Sign and date the form. The incorporators must sign to validate the document.

- Prepare the payment for the filing fee and include it with your submission.

Similar forms

The Articles of Incorporation form is similar to several other important documents in the realm of business formation and governance. Here are six documents that share similarities:

- Bylaws: These outline the internal rules and procedures for managing a corporation. Like the Articles of Incorporation, they are essential for establishing how the company operates.

- Horse Bill of Sale: To ensure the proper transfer of ownership when selling or buying a horse, utilize our detailed Horse Bill of Sale document to facilitate a smooth transaction.

- Operating Agreement: Used primarily by LLCs, this document details the management structure and operating procedures. It serves a similar purpose to the Articles of Incorporation in defining the business's framework.

- Certificate of Formation: This document is often used interchangeably with the Articles of Incorporation in some states. It serves the same purpose of formally establishing a corporation with the state.

- Partnership Agreement: This outlines the rights and responsibilities of partners in a business partnership. Like the Articles of Incorporation, it lays the groundwork for how the business will function.

- Business License: While not a formation document, a business license is required to operate legally. It complements the Articles of Incorporation by ensuring compliance with local regulations.

- Statement of Information: This document provides updated information about a corporation, such as its officers and address. It is similar to the Articles of Incorporation in that it keeps the state informed about the business's status.

Documents used along the form

When forming a corporation in West Virginia, several key documents and forms accompany the Articles of Incorporation. Each of these documents plays a vital role in ensuring that the corporation is established legally and operates smoothly. Below is a list of some of the essential forms and documents that are often used alongside the Articles of Incorporation.

- Bylaws: Bylaws outline the internal rules and procedures for the corporation's operation. They typically cover aspects such as the roles of officers, meeting protocols, and voting procedures. Having well-defined bylaws is crucial for maintaining order and governance within the corporation.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document provides information about the corporation’s structure, including its officers and registered agent. In West Virginia, while not always mandatory, filing an initial report can help establish the corporation's legitimacy.

- Certificate of Good Standing: This document verifies that a corporation is legally registered and compliant with state regulations. It can be essential for conducting business, securing loans, or entering contracts, as it assures other parties of the corporation’s status.

- Employer Identification Number (EIN): Obtaining an EIN from the Internal Revenue Service is crucial for tax purposes. This unique identifier is necessary for hiring employees, opening bank accounts, and filing taxes. It essentially serves as the corporation's Social Security number.

- Georgia Bill of Sale Form: To ensure proper transfer of ownership, consult our detailed Georgia bill of sale form guide for accurate documentation.

- Registered Agent Appointment: A registered agent is a designated individual or business entity that receives legal documents on behalf of the corporation. Appointing a registered agent is a requirement in West Virginia, ensuring that there is a reliable point of contact for official communications.

Understanding these documents is essential for anyone looking to establish a corporation in West Virginia. Each serves a specific purpose, contributing to the overall legal framework and operational integrity of the business. Properly preparing and filing these documents can facilitate a smoother incorporation process and foster long-term success.

Common mistakes

Filling out the West Virginia Articles of Incorporation form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is providing an incorrect name for the corporation. The name must be unique and not already in use by another business entity in the state. Failing to conduct a proper name search can result in rejection of the application.

Another mistake often seen is neglecting to include the correct address for the corporation's principal office. This address must be a physical location in West Virginia. Using a P.O. Box or failing to provide a complete address can cause issues. The state needs to know where to reach the corporation for legal and administrative purposes.

People also sometimes forget to include the names and addresses of the initial directors. This section is crucial because it provides transparency about who is managing the corporation. Omitting this information can lead to questions about the legitimacy of the application, potentially causing delays in the approval process.

Lastly, individuals may overlook the requirement for the incorporator's signature. The Articles of Incorporation must be signed by at least one person, and this signature is essential for validating the document. Without it, the form is incomplete and will not be processed. Attention to detail is vital when completing this form to ensure a smooth incorporation process.

Key takeaways

Filling out and using the West Virginia Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the state. Here are some key takeaways to keep in mind:

- Accurate Information is Essential: Ensure that all details provided in the form, such as the name of the corporation and the registered agent, are correct and comply with state regulations.

- Filing Fees Apply: Be prepared to pay the required filing fees when submitting the Articles of Incorporation. These fees can vary based on the type of corporation being formed.

- Understand the Purpose: Clearly state the purpose of your corporation in the form. This helps define the scope of your business activities and can impact future legal considerations.

- Seek Legal Advice if Necessary: If there are any uncertainties about the form or the incorporation process, consider consulting with a legal expert to avoid potential pitfalls.