Attorney-Verified West Virginia Deed Template

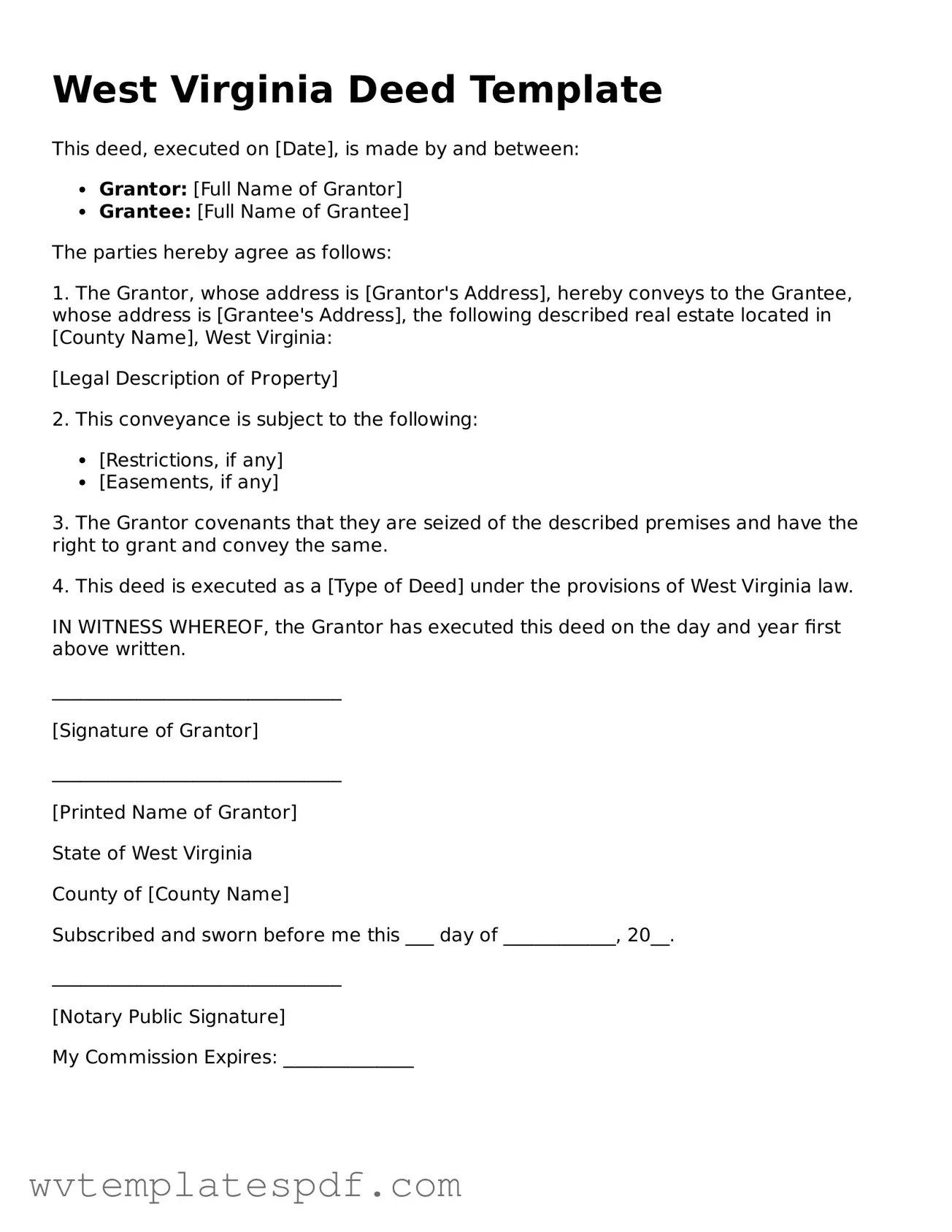

The West Virginia Deed form is an essential legal document used in real estate transactions to transfer property ownership from one party to another. This form serves as a formal record of the change in ownership and typically includes vital information such as the names of the grantor (the seller) and the grantee (the buyer), a detailed description of the property, and the date of the transfer. It may also specify any conditions or restrictions related to the property. Understanding the various types of deeds available in West Virginia, such as warranty deeds and quitclaim deeds, is crucial for both buyers and sellers. Each type serves a different purpose and offers varying levels of protection regarding ownership rights. Additionally, proper execution of the deed, including signatures and notarization, is necessary to ensure the document is legally binding and enforceable. By grasping these key aspects, individuals can navigate the process of property transfer with greater confidence and clarity.

Some Other West Virginia Forms

How to Create an Operating Agreement - This document can specify rules for non-compete agreements among members.

Notice of Intent to Homeschool Wv - A reflection of the family's decision to pursue personalized learning experiences.

The NYCERS F170 form serves as an essential tool for Tier 1, Tier 2, and Tier 4 members of the New York City Employees' Retirement System (NYCERS) who desire to opt into the 25-Year Retirement Program tailored specifically for Emergency Medical Technicians (EMTs). This form not only delineates the enrollment process but also details the criteria required for eligibility. To learn more about this vital document, members can visit nyforms.com/ for additional guidance and resources regarding their retirement options.

What Does a Dnr Mean - A DNR should reflect your personal health goals and wishes clearly.

Misconceptions

Understanding the West Virginia Deed form can be challenging due to several misconceptions. Here are eight common misunderstandings, clarified for better comprehension:

-

All deeds are the same. This is not true. Different types of deeds exist, such as warranty deeds and quitclaim deeds, each serving unique purposes and providing varying levels of protection for the buyer.

-

A deed must be notarized to be valid. While notarization is generally required for a deed to be recorded, the validity of the deed itself does not depend solely on notarization. However, a notarized deed is more likely to be accepted by the county clerk.

-

All property transactions require a lawyer. While having legal assistance can be beneficial, it is not mandatory. Many individuals complete property transactions without a lawyer, especially for straightforward cases.

-

Once a deed is recorded, it cannot be changed. This is a misconception. While the original deed cannot be altered, a new deed can be created to correct errors or update ownership information.

-

Only the seller needs to sign the deed. In reality, both the seller and the buyer should sign the deed. This ensures that both parties acknowledge the transfer of property.

-

Deeds are only necessary for selling property. Deeds are also essential for transferring property through gifts, inheritance, or other means. Any transfer of ownership typically requires a deed.

-

There is a standard fee for recording a deed. Recording fees can vary based on the county and the specific transaction. It is advisable to check with the local county clerk's office for the exact fees.

-

Once a deed is recorded, the property is automatically insured. Recording a deed does not provide insurance for the property. Homeowners should consider purchasing title insurance to protect against potential claims.

By understanding these misconceptions, individuals can navigate the process of using the West Virginia Deed form with greater confidence.

West Virginia Deed: Usage Instruction

After obtaining the West Virginia Deed form, it is essential to complete it accurately to ensure a smooth transfer of property. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the name of the grantor, the person transferring the property. Include their address.

- Next, fill in the name of the grantee, the person receiving the property. Also, include their address.

- Describe the property being transferred. This includes the physical address and any legal description required.

- Indicate the consideration amount, which is the price paid for the property.

- Sign the form where indicated. The grantor must sign in front of a notary public.

- Have the notary public sign and seal the document to validate it.

- Check for any additional requirements specific to your county, such as additional signatures or documents.

Similar forms

The Deed form is an important legal document used to transfer ownership of property or to establish certain rights. However, several other documents serve similar purposes in various contexts. Below is a list of eight documents that share similarities with the Deed form, along with explanations of how they relate.

- Title Transfer Document: This document also facilitates the transfer of property ownership. It provides proof that the seller has the right to transfer the property and that the buyer has accepted it.

- Bill of Sale: Similar to a deed, a Bill of Sale is used to transfer ownership of personal property. It serves as a receipt that outlines the terms of the sale and identifies the items being sold.

- Lease Agreement: While primarily used for renting property, a Lease Agreement can also establish rights similar to those in a deed. It outlines the terms under which a tenant can occupy a property, thereby granting certain rights to the tenant.

- Mortgage Agreement: This document secures a loan with the property as collateral. Like a deed, it involves property rights and outlines the obligations of the borrower to the lender.

- Trust Agreement: A Trust Agreement can hold property on behalf of a beneficiary. It establishes how the property is managed and transferred, similar to how a deed transfers ownership.

- Marriage Application Form: Similar to a deed, the Florida Marriage Application Form is an essential document that couples must complete to legalize their union. It requires personal information and must be submitted within 60 days of the wedding date, ensuring compliance with state regulations. For more details, visit https://floridaforms.net/blank-florida-marriage-application-form/.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can facilitate the signing of a deed when the property owner is unable to do so.

- Quitclaim Deed: This is a specific type of deed that transfers whatever interest the grantor has in the property without guaranteeing that the title is clear. It is often used between family members or in divorce settlements.

- Affidavit of Title: This document provides a sworn statement regarding the ownership of a property. It can accompany a deed to confirm the seller’s right to transfer the property and assure the buyer of its status.

Documents used along the form

When completing a property transfer in West Virginia, several forms and documents may accompany the West Virginia Deed form. Each of these documents plays a crucial role in ensuring the transaction is valid and legally binding. Below is a list of commonly used forms that may be required or beneficial during this process.

- Property Transfer Affidavit: This document provides a sworn statement regarding the transfer of property. It typically includes details about the buyer, seller, and the property being transferred. This affidavit helps establish the legitimacy of the transaction for tax purposes.

- Title Search Report: A title search report outlines the ownership history of the property. It identifies any liens, encumbrances, or other claims against the property, ensuring that the seller has the right to transfer ownership.

- Power of Attorney: If the seller or buyer cannot be present at the closing, a power of attorney allows another person to act on their behalf. This legal document must be properly executed to ensure that the representative has the authority to sign the deed and other documents. For more information, you can visit Arizona PDFs.

- Settlement Statement (HUD-1): This statement itemizes all the costs associated with the sale of the property. It details the financial aspects, including closing costs and any adjustments, providing transparency to both parties involved in the transaction.

- Power of Attorney: If the seller or buyer cannot be present at the closing, a power of attorney allows another person to act on their behalf. This legal document must be properly executed to ensure that the representative has the authority to sign the deed and other documents.

- Tax Identification Number (TIN) Form: This form may be required for tax reporting purposes. It ensures that the buyer and seller have the necessary identification for the IRS, particularly if the transaction involves a significant amount of money.

Understanding these documents can help facilitate a smoother property transfer process in West Virginia. Each form serves a specific purpose, contributing to the overall integrity and legality of the transaction. Always consider consulting a professional if there are any uncertainties regarding these documents.

Common mistakes

Filling out a West Virginia Deed form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is incorrect names. It’s essential to ensure that the names of all parties involved are spelled correctly and match their legal identification. Any discrepancies can cause issues down the line, especially if the deed needs to be referenced in legal matters.

Another common mistake involves not providing a complete property description. The description should be precise and include details such as the parcel number, lot number, and any relevant boundaries. Omitting this information can create confusion about the property being transferred, which may result in disputes or delays.

Many people forget to include the date of the transaction. This date is crucial for establishing the timeline of ownership and can be important for tax purposes. Without it, the deed may not be considered valid, leading to potential legal challenges.

Signatures are also a critical component. It’s not enough for just one party to sign; all parties involved in the transaction must sign the deed. Failing to gather all necessary signatures can render the document incomplete. Additionally, signatures must be notarized to ensure authenticity, so neglecting this step is another common pitfall.

Some individuals overlook the need for witnesses. In West Virginia, certain deeds require witnesses to validate the transaction. Not having the required number of witnesses can invalidate the deed, making it essential to check the specific requirements based on the type of deed being used.

Lastly, people often forget to file the deed with the appropriate county clerk’s office. Once the deed is completed and signed, it must be recorded to be legally recognized. Failing to file can result in the loss of rights to the property, as the deed may not be enforceable without proper recording.

Key takeaways

Filling out and using the West Virginia Deed form requires attention to detail and understanding of the process. Here are some key takeaways to keep in mind:

- Ensure accurate information: Double-check all names, addresses, and property descriptions. Mistakes can lead to legal issues or delays.

- Signature requirements: All parties involved must sign the deed. Notarization is also necessary to validate the document.

- File with the county clerk: After completing the deed, it must be filed with the appropriate county clerk's office to be legally recognized.

- Understand tax implications: Be aware of any transfer taxes or fees that may apply when executing the deed. This can vary by county.