Attorney-Verified West Virginia Last Will and Testament Template

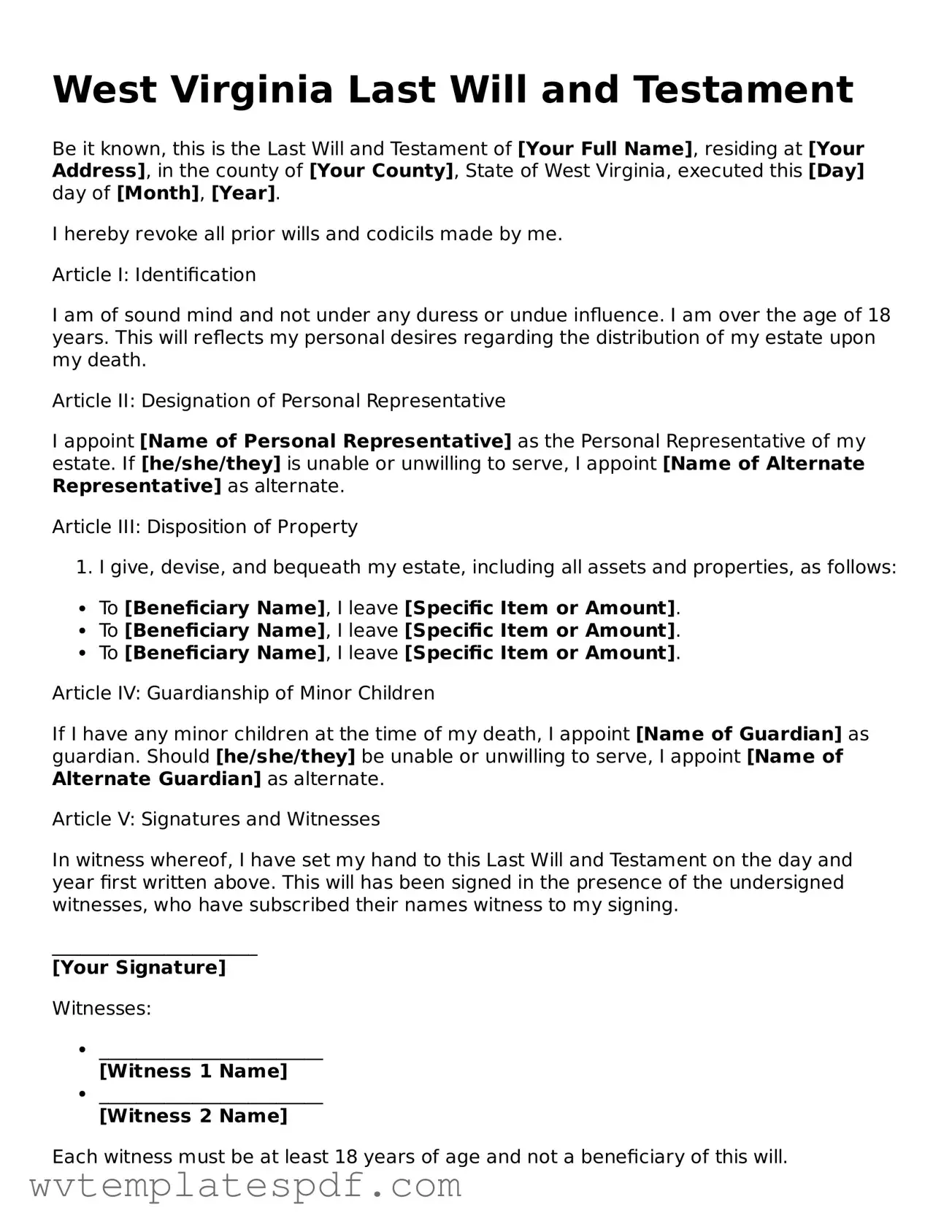

Creating a Last Will and Testament is an essential step for anyone looking to ensure their wishes are respected after their passing. In West Virginia, this legal document serves several key purposes, from distributing assets to naming guardians for minor children. The form typically includes essential details such as the testator's identity, a declaration of the document's intent, and specific instructions on how property should be allocated among beneficiaries. Additionally, it may outline the appointment of an executor, who will be responsible for managing the estate and ensuring that the terms of the will are carried out. Clarity and specificity are crucial in this document to avoid potential disputes among heirs. Understanding the nuances of the West Virginia Last Will and Testament form can empower individuals to make informed decisions about their legacies and provide peace of mind for both themselves and their loved ones.

Some Other West Virginia Forms

What Does Articles of Incorporation Look Like - Process for obtaining corporate licenses and permits.

To ensure compliance with Florida's tax regulations, businesses must accurately complete the Florida Sales Tax form, officially the Sales and Use Tax Return DR-15CS, which details gross sales, exempt sales, and taxable amounts. For more information on obtaining this form, you can visit https://floridaforms.net/blank-florida-sales-tax-form/, where specific instructions and guidance on related penalties for tax evasion can also be found.

How to Get a Lost Car Title - A Trailer Bill of Sale may also outline any liens against the trailer.

Power of Attorney West Virginia - All parties involved should fully understand the powers conveyed by the form.

Misconceptions

Understanding the West Virginia Last Will and Testament form is crucial for anyone looking to establish their final wishes. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

-

My will is valid as long as I write it down. Many people believe that simply writing their wishes on paper makes a will legally binding. In West Virginia, a will must be signed by the testator and witnessed by at least two individuals who are not beneficiaries to be considered valid.

-

Oral wills are acceptable. Some individuals think that they can verbally express their wishes and that these will be honored. In West Virginia, oral wills, or "nuncupative wills," are only recognized under very specific circumstances, primarily for military personnel or in emergencies.

-

Once I create a will, I don’t need to update it. A common belief is that a will is a one-time document. Life changes such as marriage, divorce, or the birth of a child can significantly affect your estate plan. Regular reviews and updates are essential to ensure your will reflects your current wishes.

-

All my assets will automatically go to my spouse. While many people assume that their spouse will inherit everything, West Virginia law dictates that certain assets may not be included in a will, such as jointly owned property or assets with designated beneficiaries.

-

I can create a will without legal help. Although it’s possible to create a will on your own, seeking legal advice can help ensure that the document complies with state laws and accurately reflects your intentions, reducing the risk of disputes.

-

My will can include instructions for my funeral. Many believe they can include detailed funeral instructions in their will. However, it is often better to communicate these wishes separately, as a will may not be read until after the funeral has taken place.

-

Once I sign my will, it cannot be changed. Some individuals think that a signed will is set in stone. In fact, wills can be amended or revoked at any time, provided the testator is of sound mind and follows the legal requirements for making changes.

By understanding these misconceptions, individuals can take proactive steps to ensure their Last Will and Testament accurately reflects their wishes and complies with West Virginia law.

West Virginia Last Will and Testament: Usage Instruction

Completing the West Virginia Last Will and Testament form is an important step in ensuring your wishes are honored after your passing. It is essential to fill out this document accurately to avoid potential disputes and ensure clarity for your loved ones. Below are the steps to follow when filling out the form.

- Begin by writing your full name at the top of the form.

- Clearly state your current address beneath your name.

- Indicate the date on which you are completing the will.

- Designate an executor by naming the person who will carry out your wishes. Include their full name and address.

- List your beneficiaries. Provide the names and addresses of those who will inherit your assets.

- Detail the specific assets you wish to leave to each beneficiary. Be clear and precise in your descriptions.

- Include any additional instructions or wishes regarding your assets or care of dependents.

- Sign the document at the bottom. Ensure you do this in the presence of witnesses.

- Have at least two witnesses sign the form, including their names and addresses. They should not be beneficiaries.

- Finally, date the signatures of your witnesses to validate the document.

Similar forms

- Living Will: This document outlines your wishes regarding medical treatment in case you become unable to communicate. Like a Last Will, it reflects your personal decisions, but it focuses on health care rather than the distribution of assets.

- Power of Attorney: A Power of Attorney allows someone to make decisions on your behalf if you are unable to do so. While a Last Will deals with what happens after your death, this document is effective during your lifetime.

- Trust Agreement: A Trust Agreement is used to manage your assets during your lifetime and after your death. It provides a way to distribute assets, similar to a Last Will, but often allows for more control over how and when beneficiaries receive their inheritance.

- Advance Directive: This document specifies your preferences for medical treatment and end-of-life care. Like a Last Will, it ensures your wishes are honored, but it pertains to health care decisions rather than property distribution.

- Codicil: A Codicil is an amendment to an existing Last Will. It allows you to make changes without creating an entirely new will, ensuring your wishes are up-to-date while maintaining the original document's validity.

- Letter of Intent: This informal document communicates your wishes to your loved ones and can guide them in executing your Last Will. It may include personal messages or instructions that are not legally binding but can help clarify your intentions.

- Beneficiary Designation: This document specifies who will receive certain assets, like life insurance or retirement accounts, upon your death. It works alongside a Last Will but can supersede it for those specific assets.

- ATV Bill of Sale: The California Templates provide a comprehensive form that facilitates the legal transfer of ownership for ATVs in California, ensuring that all necessary details are accurately recorded for both parties involved in the sale.

- Guardianship Designation: If you have minor children, this document allows you to designate a guardian for them. While a Last Will can include this information, a separate guardianship designation can provide additional clarity and legal support for your choice.

Documents used along the form

When creating a Last Will and Testament in West Virginia, individuals often consider additional documents to ensure their estate planning is comprehensive. These documents serve various purposes, from outlining healthcare preferences to managing assets during incapacity. Below are some commonly used forms that complement a will.

- Durable Power of Attorney: This document allows an individual to appoint someone else to manage their financial affairs if they become incapacitated. It grants the designated person the authority to make decisions regarding bank accounts, property, and other financial matters.

- Healthcare Power of Attorney: This form designates a trusted person to make medical decisions on behalf of an individual if they are unable to do so. It ensures that healthcare preferences are respected and that someone is authorized to communicate with medical professionals.

- Living Will: A living will outlines an individual's wishes regarding medical treatment in situations where they cannot express their preferences. This document typically addresses end-of-life care and the use of life-sustaining measures.

- General Power of Attorney: This form grants broad authority to an agent to act on behalf of another in various matters, including financial and legal decisions. For more information, you can refer to Arizona PDFs.

- Revocable Trust: A revocable trust allows individuals to transfer assets into a trust during their lifetime. This can help avoid probate, manage assets, and provide instructions for distribution upon death. The individual retains control over the trust and can modify it as needed.

Incorporating these documents into an estate plan can provide clarity and peace of mind. Each plays a vital role in ensuring that personal wishes are honored and that financial and medical decisions are handled appropriately when the need arises.

Common mistakes

Filling out a Last Will and Testament form in West Virginia can seem straightforward, but many people make common mistakes that can lead to complications later. One frequent error is not being specific about the distribution of assets. It is essential to clearly outline who receives what. Vague language can create confusion and may lead to disputes among heirs.

Another mistake involves failing to update the will after major life events. Changes such as marriage, divorce, or the birth of children should prompt a review of the will. If these changes are not reflected, the will may not accurately represent the individual's current wishes.

Many people neglect to sign the will properly. In West Virginia, the testator must sign the document in the presence of at least two witnesses, who must also sign. Without these signatures, the will may not be valid. Additionally, some individuals mistakenly think that a handwritten note can replace a formal will. While handwritten changes can be valid under certain circumstances, they often lead to confusion and should be avoided.

Another common oversight is not considering the choice of executor. The executor is responsible for carrying out the instructions in the will. Choosing someone who is not trustworthy or capable can lead to problems down the line. It is crucial to select someone who is organized and understands the responsibilities involved.

People often forget to include a clause for the payment of debts and taxes. If these obligations are not addressed, they may fall to the heirs, which can diminish the inheritance they receive. Clearly stating how debts and taxes should be handled can prevent this issue.

Some individuals also overlook the importance of discussing their wishes with family members. Open communication can help avoid misunderstandings and conflicts after the individual passes away. When family members know the testator’s intentions, they are less likely to contest the will.

Another mistake is not considering the implications of state laws. West Virginia has specific requirements for wills that must be followed. Ignoring these can lead to a will being declared invalid. It is wise to familiarize oneself with these laws or seek assistance when necessary.

Additionally, many people fail to store the will in a safe and accessible location. If the will cannot be found when needed, the testator's wishes may not be honored. Keeping the will in a safe deposit box or with a trusted attorney can help ensure it is available when required.

Finally, some individuals do not seek professional help when needed. While it is possible to fill out a will on one’s own, consulting with an attorney can provide valuable guidance. An attorney can help identify potential issues and ensure that the will meets all legal requirements.

Key takeaways

Creating a Last Will and Testament is an important step in ensuring your wishes are respected after you pass away. In West Virginia, there are specific considerations to keep in mind when filling out this legal document. Here are some key takeaways to help you navigate the process:

- Understand the Purpose: A Last Will and Testament outlines how you want your assets distributed after your death. It can also designate guardians for minor children.

- Be Clear and Specific: Clearly list your assets and specify who will receive each item. Ambiguities can lead to disputes among heirs.

- Choose an Executor: Select a trustworthy person to manage your estate. This individual will be responsible for ensuring your wishes are carried out.

- Witness Requirements: In West Virginia, your will must be signed by at least two witnesses who are not beneficiaries. This helps validate the document.

- Revocation of Previous Wills: If you create a new will, it automatically revokes any previous wills. Make sure to dispose of old versions to avoid confusion.

- Consider Legal Assistance: While you can fill out the form on your own, consulting with an attorney can provide peace of mind and ensure that all legal requirements are met.

Taking the time to carefully prepare your Last Will and Testament can provide clarity and peace for your loved ones during a difficult time. Make sure to review your will periodically, especially after major life changes.