Attorney-Verified West Virginia Operating Agreement Template

The West Virginia Operating Agreement form is a crucial document for any limited liability company (LLC) operating within the state. It serves as a foundational blueprint that outlines the management structure, operational procedures, and ownership interests of the company. By clearly defining the roles and responsibilities of members, this agreement helps prevent misunderstandings and disputes among co-owners. Additionally, it specifies how profits and losses will be distributed, ensuring that all parties are on the same page regarding financial matters. The form also addresses important aspects such as voting rights, decision-making processes, and procedures for adding or removing members. Furthermore, it provides guidelines for handling disputes and outlines the process for amending the agreement in the future. Having a well-drafted Operating Agreement not only fosters transparency but also enhances the credibility of the LLC in the eyes of potential investors and partners. In West Virginia, while it is not legally required to have this agreement, doing so is highly advisable for anyone looking to establish a solid legal foundation for their business.

Some Other West Virginia Forms

How to Get a Lost Car Title - This document helps detail any warranties or guarantees related to the vehicle sold.

The IRS W-9 form is a crucial document used by individuals and businesses to provide their taxpayer identification information. Primarily, it helps facilitate accurate tax reporting for clients, contractors, and freelancers. For more information on how to correctly complete this form, you can refer to the Taxpayer Identification Request, as understanding how to properly use this form can significantly impact your tax obligations and streamline your financial transactions.

What Is a Hold Harmless Agreement - This agreement can be essential in events where there is a potential for accidents or damage to property.

Misconceptions

Many people have misunderstandings about the West Virginia Operating Agreement form. Here are nine common misconceptions, along with clarifications to help clear things up.

- It’s only necessary for large businesses. Many believe that only large companies need an Operating Agreement. In reality, even small businesses and LLCs benefit from having one. It provides structure and clarity.

- It’s the same as a business plan. Some confuse the Operating Agreement with a business plan. While a business plan outlines goals and strategies, the Operating Agreement focuses on the internal workings of the company.

- All members must agree on every decision. There’s a misconception that unanimous consent is required for all decisions. The Operating Agreement can specify different voting rights and decision-making processes, allowing for flexibility.

- It’s a one-time document. Many think the Operating Agreement is set in stone. However, it can and should be updated as the business evolves or as member circumstances change.

- It’s only for multi-member LLCs. Some believe that single-member LLCs do not need an Operating Agreement. Even for a single-member LLC, having an Operating Agreement is beneficial for legal protection and clarity.

- It’s not legally binding. A common myth is that the Operating Agreement holds no legal weight. In fact, it is a legally binding document that outlines the rights and responsibilities of members.

- It must be filed with the state. There’s a misconception that the Operating Agreement must be submitted to the state. This document is typically kept internally and does not need to be filed.

- It can be written informally. Some think that an informal agreement or verbal understanding is sufficient. While informal agreements may work temporarily, a formal written Operating Agreement is crucial for clarity and protection.

- It’s only about ownership percentages. Many focus solely on ownership stakes. While that’s important, the Operating Agreement also covers management structure, profit distribution, and procedures for resolving disputes.

Understanding these misconceptions can help business owners make informed decisions about their Operating Agreements. It's a vital tool for ensuring smooth operations and protecting all parties involved.

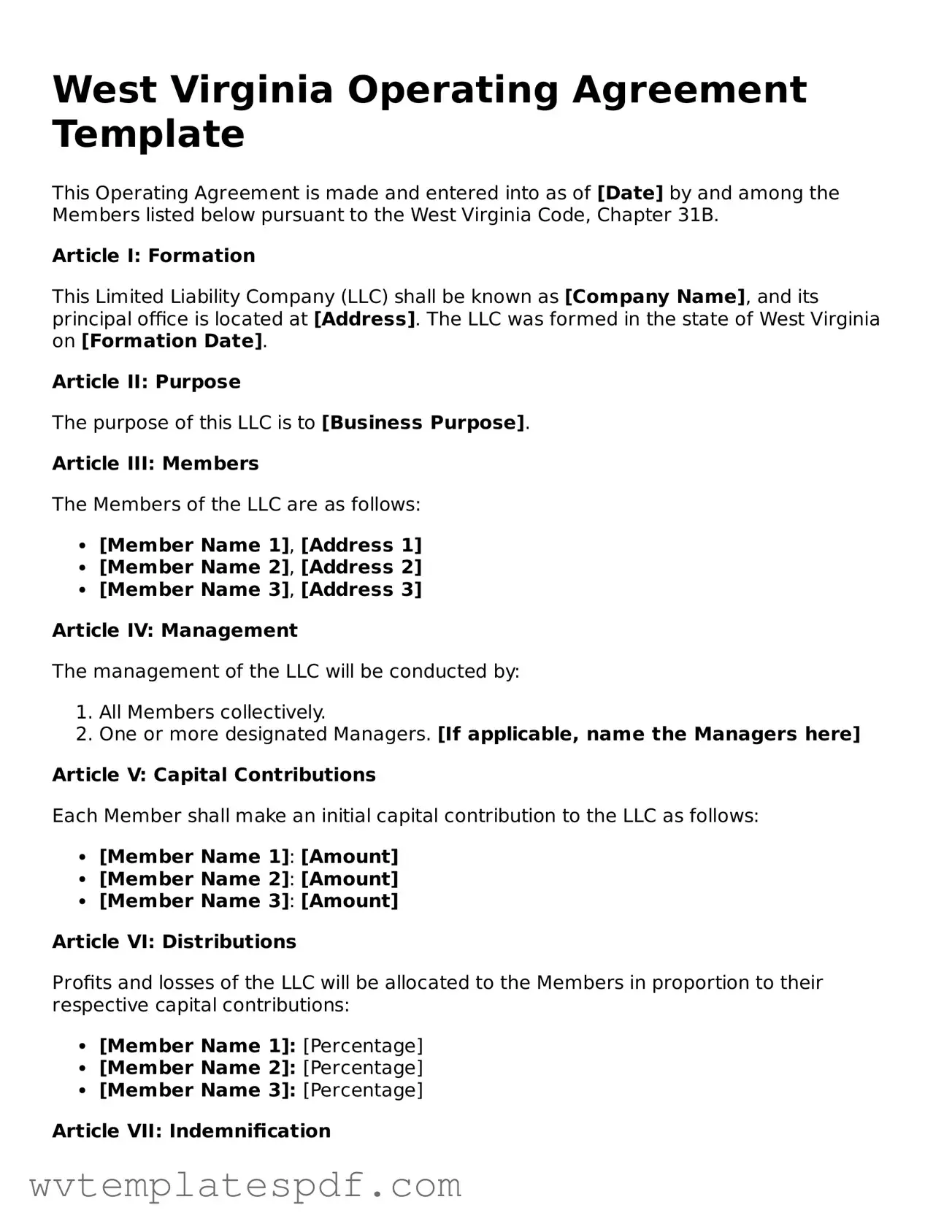

West Virginia Operating Agreement: Usage Instruction

Completing the West Virginia Operating Agreement form is an important step in establishing your business structure. This document outlines the management and operational procedures of your business. After filling out the form, you will need to review it carefully and ensure all members sign it. This will solidify the agreement and provide clarity moving forward.

- Begin by entering the name of your business at the top of the form.

- Fill in the principal office address. This should be a physical address where your business operates.

- List the names and addresses of all members involved in the business.

- Specify the purpose of your business. Clearly state what your business will do.

- Indicate the management structure. Decide if it will be member-managed or manager-managed.

- Outline the voting rights of each member. Determine how decisions will be made.

- Detail the profit and loss distribution among members. Specify how earnings will be shared.

- Include any additional provisions that may be necessary for your specific business needs.

- Review all information for accuracy and completeness.

- Have all members sign the agreement to finalize it.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the rules and procedures for managing a corporation. They detail the roles of officers, how meetings are conducted, and voting procedures.

- Partnership Agreement: This document serves a similar purpose for partnerships. It defines the relationship between partners, their contributions, profit-sharing, and responsibilities.

- Shareholder Agreement: This agreement is akin to an Operating Agreement for corporations. It sets out the rights and obligations of shareholders, including how shares can be transferred and how decisions are made.

- Power of Attorney: This legal document allows individuals in Arizona to designate someone to make decisions on their behalf, covering essential areas such as financial matters and healthcare. For further insights, you can refer to the Arizona PDFs.

- Membership Agreement: Often used in limited liability companies (LLCs), this document outlines the rights and responsibilities of members, similar to how an Operating Agreement functions.

- Joint Venture Agreement: This document governs the relationship between two or more parties working together on a specific project. It details contributions, profit-sharing, and management responsibilities.

- Employment Agreement: While focused on the employer-employee relationship, this document can outline roles and responsibilities, akin to how an Operating Agreement defines member roles.

- Non-Disclosure Agreement (NDA): Though different in purpose, an NDA can be part of the operational framework by protecting sensitive information shared among members, similar to confidentiality clauses in an Operating Agreement.

- Franchise Agreement: This document governs the relationship between a franchisor and franchisee. It outlines rights, responsibilities, and operational guidelines, much like an Operating Agreement does for LLC members.

- Articles of Incorporation: This document establishes a corporation's existence and includes basic information about the business. While it does not govern operations, it is foundational like an Operating Agreement.

Documents used along the form

The West Virginia Operating Agreement is a critical document for Limited Liability Companies (LLCs) in the state. It outlines the management structure, member responsibilities, and operational procedures. Alongside this agreement, several other documents play an essential role in the formation and governance of an LLC. Below are four important forms and documents that are often used in conjunction with the West Virginia Operating Agreement.

- Articles of Organization: This document is filed with the West Virginia Secretary of State to officially create the LLC. It includes essential information such as the company name, registered agent, and business purpose.

- Member Consent Form: This form is used to document the agreement of members to the terms set forth in the Operating Agreement. It serves as a record of each member's approval and can be vital for future reference.

- Horse Bill of Sale: For those involved in equine transactions, the comprehensive Horse Bill of Sale documentation is essential for legally verifying ownership transfer.

- Bylaws: While not required for LLCs, bylaws can provide additional structure. They outline the rules and procedures for the internal management of the LLC, including voting rights and meeting protocols.

- Tax Identification Number (TIN) Application: This document is necessary for tax purposes. Obtaining a TIN allows the LLC to hire employees, open bank accounts, and file taxes under its own name.

Understanding these documents is crucial for anyone involved in the formation and management of an LLC in West Virginia. Each plays a specific role in ensuring compliance and facilitating smooth operations within the company.

Common mistakes

When filling out the West Virginia Operating Agreement form, it’s easy to overlook important details. One common mistake is failing to include all members’ names and addresses. Each member's information should be accurate and up-to-date. Omitting a member can lead to confusion and potential legal issues down the line.

Another frequent error is not specifying the management structure. The form should clearly outline whether the LLC will be managed by its members or by appointed managers. This clarity helps prevent disputes among members regarding decision-making processes.

Some individuals neglect to define the purpose of the LLC. While it may seem straightforward, stating the business purpose helps establish the scope of operations and can be beneficial for legal and tax purposes.

Additionally, many people forget to include the capital contributions of each member. It’s essential to document how much each member is contributing to the LLC. This information is crucial for determining ownership percentages and profit distribution.

Not addressing the distribution of profits and losses is another mistake. The Operating Agreement should specify how profits and losses will be allocated among members. This prevents misunderstandings and ensures that everyone is on the same page.

Some individuals may also overlook the importance of including procedures for member withdrawal or addition. Having clear guidelines in place for these situations can save time and prevent conflicts in the future.

Lastly, failing to review the document thoroughly before submission can lead to errors. A careful review helps catch mistakes that could otherwise cause complications later. Taking the time to double-check the information ensures that the Operating Agreement is complete and accurate.

Key takeaways

When filling out and using the West Virginia Operating Agreement form, keep the following key takeaways in mind:

- Ensure all members' names and addresses are accurately listed. This information is crucial for communication and legal purposes.

- Clearly define the management structure. Decide whether the LLC will be member-managed or manager-managed to avoid confusion down the line.

- Include provisions for profit and loss distribution. Specify how profits and losses will be shared among members to prevent disputes.

- Outline the process for adding or removing members. Having a clear procedure in place helps maintain stability within the organization.

- Consider including a dispute resolution mechanism. This can save time and money if conflicts arise among members.

- Review the agreement regularly. As your business evolves, so should your Operating Agreement. Regular updates ensure it remains relevant.

By keeping these points in mind, you can create a solid foundation for your LLC in West Virginia. A well-prepared Operating Agreement can help prevent misunderstandings and foster a positive working relationship among members.