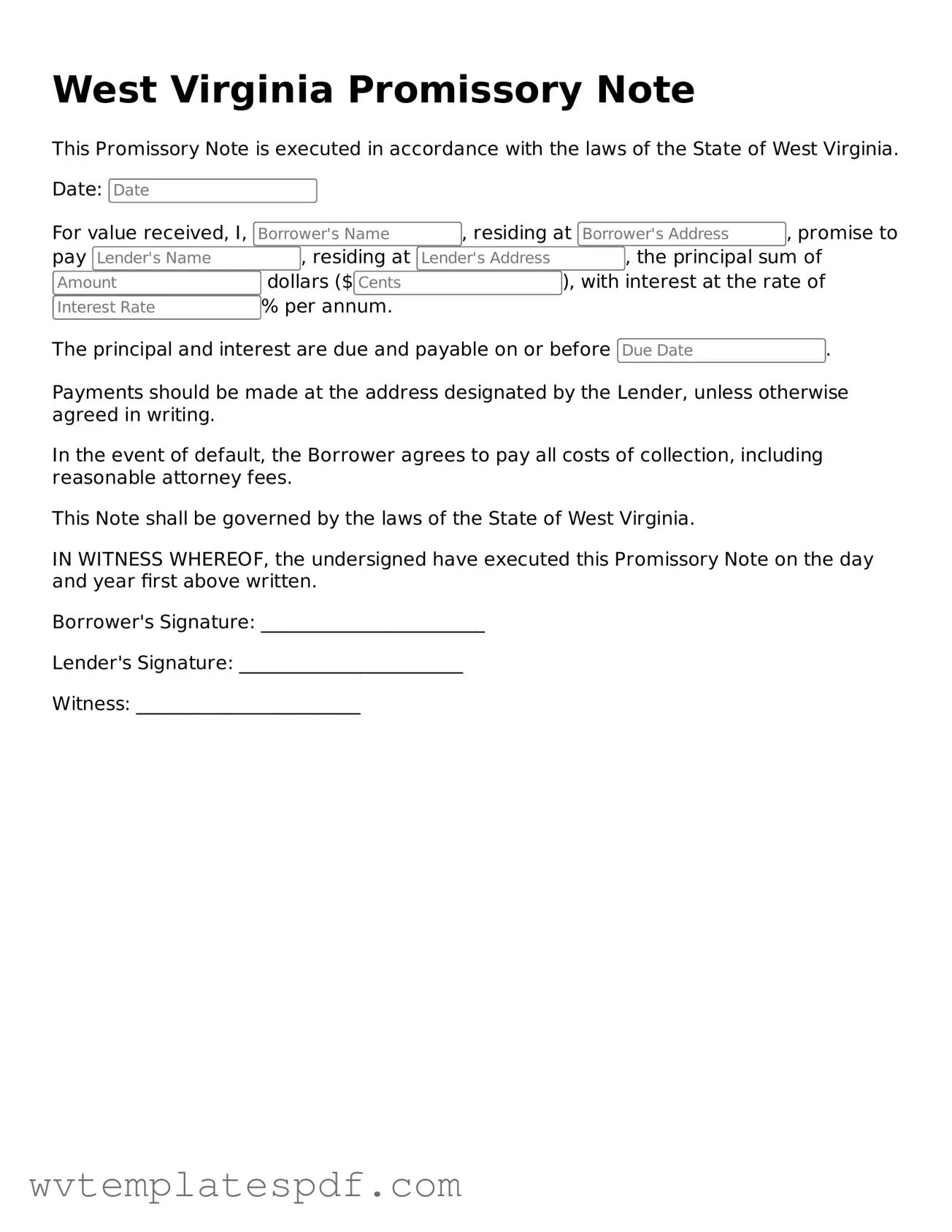

Attorney-Verified West Virginia Promissory Note Template

The West Virginia Promissory Note form serves as a vital document in financial transactions, ensuring clarity and legal standing between parties involved in a loan agreement. This form outlines the borrower's promise to repay a specified amount of money to the lender, detailing the terms of repayment, interest rates, and any applicable fees. It also specifies the consequences of default, providing both parties with a clear understanding of their rights and obligations. The document includes essential information such as the names and addresses of the borrower and lender, the loan amount, and the repayment schedule. By using this form, individuals and businesses can create a legally binding agreement that protects their interests and fosters trust in financial dealings. Whether for personal loans, business financing, or real estate transactions, the West Virginia Promissory Note form is a crucial tool for establishing a formal record of the loan arrangement.

Some Other West Virginia Forms

Is an Eviction Notice Final - A Notice to Quit should be issued professionally and without emotion.

For those looking to understand the requirements for completing a transaction in Florida, the comprehensive Horse Bill of Sale is an indispensable resource. This document not only aids in establishing a clear record of ownership transfer but also ensures both parties are safeguarded during the sale process.

Employee Handbook Creation - Read our policy on telecommuting and remote work options.

Misconceptions

Understanding the West Virginia Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often arise that can lead to confusion. Here are nine common misconceptions explained.

-

All Promissory Notes are the Same:

Many people believe that all promissory notes are identical. In reality, they can vary significantly in terms of terms, conditions, and legal requirements based on state laws.

-

Only Banks Can Use Promissory Notes:

This is not true. Individuals and businesses can create and use promissory notes for personal loans, business transactions, or any agreement where money is borrowed.

-

A Promissory Note Must Be Notarized:

While notarization can add an extra layer of security, it is not a legal requirement for a promissory note to be enforceable in West Virginia.

-

Verbal Agreements Are Enough:

Some believe that a verbal agreement is sufficient for a loan. However, having a written promissory note provides clear evidence of the terms and protects both parties.

-

Promissory Notes Are Only for Large Loans:

This misconception overlooks the fact that promissory notes can be used for any amount, big or small. They are versatile financial tools.

-

They Are Difficult to Enforce:

While enforcing a promissory note can be complex, having a well-drafted note makes it much easier to pursue legal action if necessary.

-

Interest Rates Are Fixed:

Some assume that all promissory notes must have a fixed interest rate. In fact, the interest rate can be negotiated and specified in the note.

-

Once Signed, They Cannot Be Changed:

It is a common belief that changes cannot be made after signing. However, both parties can agree to modify the terms, provided it is documented properly.

-

They Are Only for Personal Loans:

This misconception limits the use of promissory notes. They are equally applicable in business transactions, real estate deals, and more.

Addressing these misconceptions can help individuals and businesses navigate their financial agreements more effectively. Always consider consulting with a professional when drafting or signing a promissory note.

West Virginia Promissory Note: Usage Instruction

Once you have your West Virginia Promissory Note form ready, it’s important to fill it out accurately to ensure clarity and enforceability. Follow these steps to complete the form correctly.

- Identify the Parties: Write the full legal names of both the borrower and the lender at the top of the form. Make sure to include any relevant titles or designations.

- Enter the Loan Amount: Clearly state the total amount of money being borrowed. This should be in both numerical and written form to avoid confusion.

- Specify the Interest Rate: Indicate the interest rate being charged on the loan. If there is no interest, write “0%.”

- Set the Payment Schedule: Outline the repayment terms. Specify how often payments will be made (e.g., monthly, quarterly) and the due date for the first payment.

- Include Late Fees (if applicable): If there are penalties for late payments, clearly state the amount or percentage that will be charged.

- Define the Maturity Date: Indicate the date by which the loan must be fully repaid.

- Signatures: Both parties must sign and date the form. Include printed names below the signatures for clarity.

- Witness or Notary (if required): Depending on the specific requirements, you may need a witness or notary public to sign the document as well.

After completing the form, review it carefully to ensure all information is accurate. Both parties should keep a signed copy for their records.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule.

- Mortgage: A mortgage is a type of promissory note secured by real property. It includes terms for repayment and the consequences of default.

- Installment Agreement: This document details a payment plan for a debt, similar to a promissory note, specifying amounts and due dates for each installment.

- Durable Power of Attorney: The Durable Power of Attorney form allows an individual to appoint someone to manage their financial and legal affairs, remaining effective even if they become incapacitated.

- Credit Agreement: A credit agreement establishes the terms under which credit is extended, including repayment obligations, much like a promissory note.

- Personal Loan Agreement: This is a specific type of loan agreement that outlines the terms of a personal loan, including repayment and interest, akin to a promissory note.

- Secured Note: A secured note is backed by collateral, similar to a promissory note, but includes additional details about the collateral securing the loan.

- Business Loan Agreement: This document is used for business loans, detailing the terms and conditions of the loan, mirroring the structure of a promissory note.

- Debt Settlement Agreement: This agreement outlines the terms for settling a debt for less than the full amount owed, resembling a promissory note in its payment terms.

Documents used along the form

When entering into a financial agreement, such as a loan, it's important to have all the necessary documents in place. Along with the West Virginia Promissory Note form, several other forms and documents may be used to ensure clarity and legal protection for all parties involved. Below is a list of commonly used documents that complement the Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any penalties for late payments. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document specifies what asset is being used as security. It details the rights of the lender in the event of default and provides a legal claim to the collateral.

- Residential Lease Agreement: This document outlines the terms and conditions between a landlord and tenant for renting residential property in Arizona. For a comprehensive template, you can refer to Arizona PDFs.

- Personal Guarantee: This document is often used when a business borrows money. It holds an individual personally responsible for repaying the loan if the business cannot. This adds an extra layer of security for the lender.

- Disclosure Statement: Lenders are often required to provide this document to inform borrowers about the terms of the loan, including all fees and the annual percentage rate (APR). Transparency is key to ensuring borrowers understand their obligations.

- Amortization Schedule: This is a table that outlines each payment over the life of the loan. It shows how much of each payment goes toward interest and how much goes toward the principal balance. This can help borrowers plan their finances.

- Default Notice: In the event of missed payments, this document is sent to the borrower to formally notify them of the default. It outlines the consequences and the steps the lender may take to recover the owed amount.

Having these documents prepared and understood can significantly reduce misunderstandings and disputes between lenders and borrowers. They provide a clear framework for the loan transaction and help protect the interests of all parties involved.

Common mistakes

When filling out the West Virginia Promissory Note form, many individuals make common mistakes that can lead to confusion or legal issues. One frequent error is not providing complete information. All sections of the form must be filled out accurately. Omitting details, such as the borrower’s name or the loan amount, can render the document invalid.

Another mistake involves incorrect dates. The date of the note is crucial, as it establishes the timeline for repayment. If the date is left blank or filled in incorrectly, it may complicate the enforcement of the agreement. Always double-check the date to ensure it reflects the actual date of signing.

People often overlook the importance of signatures. Both the borrower and the lender must sign the document for it to be legally binding. Failing to include one or both signatures can lead to disputes over the terms of the loan. It is essential to ensure that all necessary parties have signed before finalizing the document.

Additionally, using vague language can create problems. The terms of the loan, including the interest rate and repayment schedule, should be clearly stated. Ambiguities in the wording can lead to misunderstandings down the line. Clear and precise language helps both parties understand their obligations.

Lastly, individuals sometimes forget to make copies of the completed Promissory Note. Keeping a copy for personal records is important for future reference. If any issues arise, having documentation can provide clarity and support for both parties involved.

Key takeaways

When dealing with a West Virginia Promissory Note, there are several important points to keep in mind. Here are key takeaways to help you navigate the process smoothly:

- Understand the Purpose: A promissory note is a written promise to pay a specific amount of money to a specific person at a specific time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that everyone knows who is involved.

- Specify the Amount: Clearly write the principal amount being borrowed. This figure should be accurate to avoid confusion later.

- Detail the Terms: Outline the repayment schedule, including due dates and any interest rates. This helps both parties understand their obligations.

- Include Signatures: Both the borrower and lender must sign the note. This step is crucial for the document to be legally binding.

- Keep Copies: After filling out the note, make sure both parties keep a copy. This protects everyone involved and provides a reference if needed.

- Consult a Professional: If you have questions or concerns, consider seeking legal advice. A professional can help clarify any uncertainties.