Attorney-Verified West Virginia Real Estate Purchase Agreement Template

When buying or selling property in West Virginia, having a clear and comprehensive Real Estate Purchase Agreement form is essential. This document serves as the backbone of the transaction, outlining the terms and conditions agreed upon by both the buyer and the seller. Key aspects of the agreement include the purchase price, the legal description of the property, and the closing date. It also details any contingencies, such as financing or inspections, that must be satisfied before the sale can proceed. Additionally, the form addresses the responsibilities of each party, including disclosures and any necessary repairs. By ensuring that all these elements are clearly stated, the agreement helps protect the interests of both parties and paves the way for a smooth transaction. Understanding this form is crucial for anyone involved in real estate in West Virginia, as it lays the groundwork for a successful sale or purchase.

Some Other West Virginia Forms

How to Get Financial Power of Attorney - The agent's responsibilities should be clearly defined in the document.

The NYCERS F170 form is an essential tool for EMT members seeking to understand their retirement options better, and for detailed guidance, members can refer to nyforms.com/, which provides valuable insights into the application process and program specifics, ensuring that all eligible participants can navigate their retirement planning effectively.

Power of Attorney West Virginia - This document helps prevent delays in vehicle transfers or registrations.

Whats an Nda - Having an NDA in place can encourage openness in sharing ideas and innovations.

Misconceptions

Understanding the West Virginia Real Estate Purchase Agreement form is crucial for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here are ten common misconceptions, along with clarifications to help you navigate this important document.

- It is a legally binding contract immediately upon signing. Many believe that signing the agreement makes it legally binding right away. In reality, the agreement often requires additional steps, such as acceptance by the seller and possibly other contingencies.

- All real estate transactions in West Virginia require this form. Some think that every property transaction must use the Real Estate Purchase Agreement form. However, not all transactions require this specific document; alternative agreements may be used depending on the situation.

- Verbal agreements are sufficient. A common myth is that verbal agreements are enough to finalize a sale. In West Virginia, real estate transactions typically need to be documented in writing to be enforceable.

- Once signed, terms cannot be changed. Many assume that once the agreement is signed, the terms are set in stone. However, parties can negotiate changes before closing, as long as both agree to the modifications.

- The form is the same for all types of properties. Some believe that one standard form applies to all property types. In fact, different types of properties, such as residential and commercial, may have tailored forms to address specific needs.

- It does not require a real estate agent. There is a misconception that buyers and sellers can navigate the agreement without professional help. While it is possible, having a real estate agent can provide valuable guidance and ensure all aspects are covered.

- Only the buyer needs to sign the agreement. A common misunderstanding is that only the buyer's signature is necessary. Both the buyer and seller must sign the agreement for it to be valid.

- Contingencies are optional and can be ignored. Some believe that contingencies, like financing or inspection clauses, are optional. In reality, they are crucial for protecting the interests of both parties and should be carefully considered.

- The agreement guarantees a successful closing. Signing the agreement does not guarantee that the sale will close. Various factors, such as financing issues or inspection results, can affect the outcome.

- Legal advice is unnecessary. Many think that they can fill out the form without any legal assistance. However, consulting with a legal expert can help clarify obligations and rights, ensuring a smoother transaction.

Being aware of these misconceptions can empower you to approach the West Virginia Real Estate Purchase Agreement with greater confidence and understanding. Always consider seeking professional advice to ensure your interests are protected throughout the process.

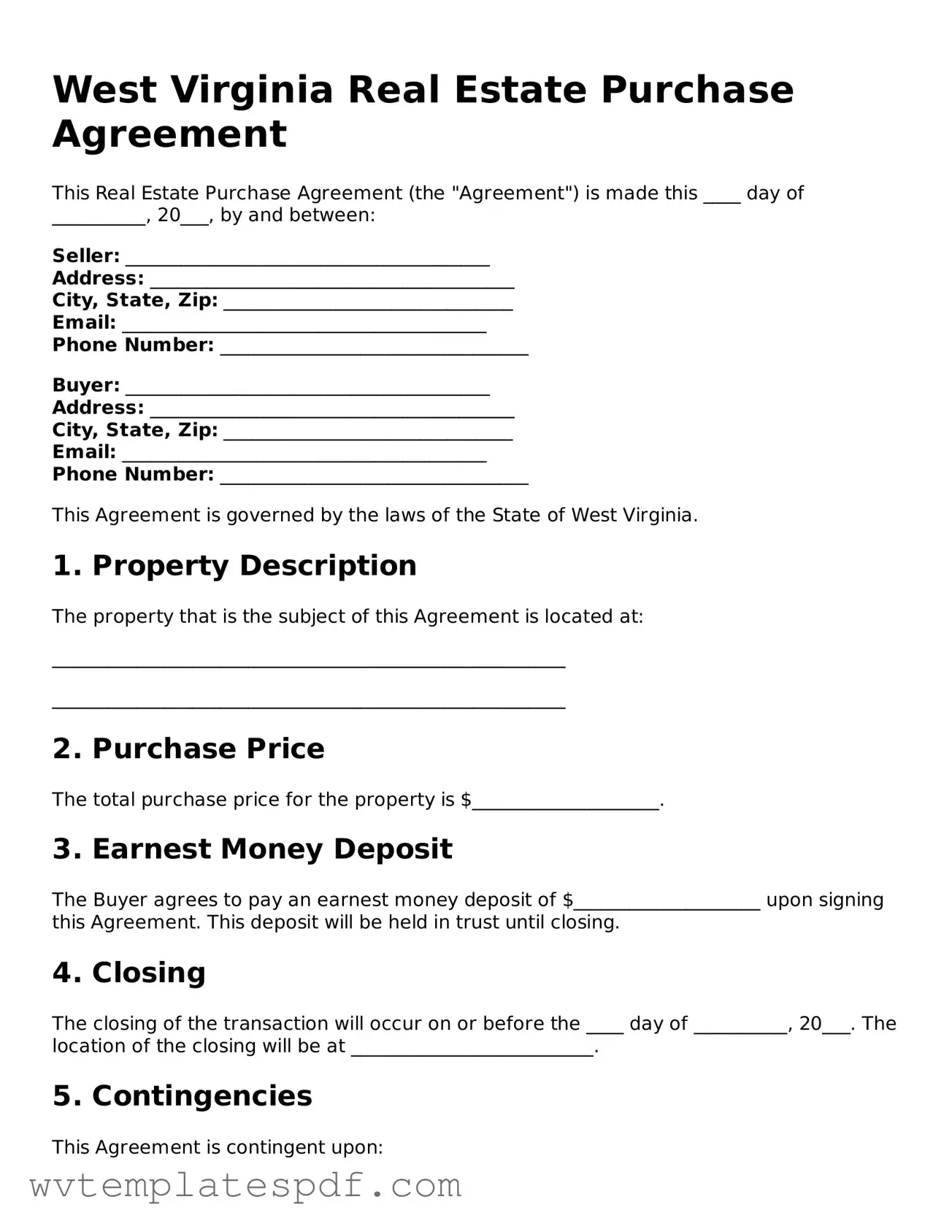

West Virginia Real Estate Purchase Agreement: Usage Instruction

After gathering the necessary information and documents, you are ready to fill out the West Virginia Real Estate Purchase Agreement form. This document will outline the terms of the sale and protect the interests of both the buyer and the seller. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form.

- Identify the parties involved. Fill in the names and addresses of both the buyer and the seller.

- Provide a detailed description of the property being sold. Include the address and any relevant parcel or tax identification numbers.

- Specify the purchase price. Clearly state the total amount the buyer agrees to pay for the property.

- Outline the terms of payment. Indicate whether the buyer will pay in cash, through financing, or a combination of both.

- Detail any contingencies. This may include conditions like home inspections, financing approval, or other requirements that must be met for the sale to proceed.

- Include the closing date. Specify when the sale will be finalized and ownership transferred.

- Sign and date the agreement. Both the buyer and seller must sign the document to make it legally binding.

Once you have completed the form, review it for accuracy. Ensure all parties have a copy of the signed agreement for their records. This step is crucial for a smooth transaction.

Similar forms

-

Lease Agreement: This document outlines the terms under which a landlord allows a tenant to occupy property. Like the Real Estate Purchase Agreement, it specifies the parties involved, the property description, and the terms of the agreement, including payment amounts and duration.

-

Option to Purchase Agreement: This agreement gives a tenant the right to purchase the property at a later date. Similar to the Real Estate Purchase Agreement, it details the purchase price and conditions under which the sale can occur, but it does not require an immediate transaction.

-

Sales Contract: Often used in various types of transactions, this document serves to formalize the sale of goods or services. Like the Real Estate Purchase Agreement, it includes essential terms such as price, parties involved, and obligations, but it is generally used for non-real estate transactions.

-

Listing Agreement: This document is used between a property owner and a real estate agent to sell a property. It shares similarities with the Real Estate Purchase Agreement in that it includes details about the property and the terms of the sale, but it primarily focuses on the relationship between the seller and the agent.

-

Notice to Quit: It is crucial for landlords to provide tenants with a formal Arizona PDFs notice when they need the tenant to vacate the property, ensuring legal compliance and clarity in the eviction process.

-

Purchase and Sale Agreement: This document is similar to the Real Estate Purchase Agreement in that it outlines the terms of a real estate transaction. It typically includes details about the property, purchase price, and closing date, but it may also cover additional contingencies and conditions that must be met before the sale is finalized.

Documents used along the form

When engaging in a real estate transaction in West Virginia, several documents often accompany the Real Estate Purchase Agreement. These documents help clarify terms, protect parties' interests, and ensure compliance with state laws. Below is a list of commonly used forms and documents in conjunction with the purchase agreement.

- Disclosure Statement: This document provides essential information about the property's condition, including any known defects or issues. Sellers are required to disclose material facts that could affect the buyer's decision.

- Title Report: A title report outlines the legal ownership of the property and any encumbrances, such as liens or easements. It ensures that the seller has the right to sell the property and that the buyer will receive clear title.

- Purchase Money Mortgage: This document outlines the terms of financing provided by the seller to the buyer. It details the loan amount, interest rate, and repayment schedule, serving as a security interest in the property.

- Home Inspection Report: Conducted by a qualified inspector, this report assesses the property's condition. Buyers often request this document to identify potential issues before finalizing the purchase.

- Appraisal Report: An appraisal determines the property's market value. Lenders typically require this report to ensure the property's value aligns with the loan amount.

- Closing Disclosure: This document provides a detailed account of all closing costs, including fees and expenses. It must be provided to the buyer at least three days before closing.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It includes a description of the property and must be recorded with the county clerk.

- Florida Marriage Application Form: Couples wishing to legalize their union in Florida must complete the floridaforms.net/blank-florida-marriage-application-form/ as a preliminary step, which outlines the necessity of obtaining a license within 60 days of the intended wedding date.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this document informs buyers about potential lead-based paint hazards. Sellers must disclose known information about lead paint and provide buyers with a pamphlet on lead safety.

Understanding these documents is crucial for anyone involved in a real estate transaction. Each plays a significant role in ensuring a smooth and legally compliant process. Always consult with a qualified professional to navigate these forms effectively.

Common mistakes

Filling out the West Virginia Real Estate Purchase Agreement form can be a daunting task. One common mistake is failing to include all necessary parties in the agreement. Buyers and sellers must ensure that all individuals involved in the transaction are listed. Omitting a co-owner or an interested party can lead to legal complications down the line.

Another frequent error is neglecting to specify the terms of the sale clearly. This includes the purchase price, closing date, and any contingencies. Ambiguities can create misunderstandings and disputes. Ensure that every detail is explicit to avoid potential conflicts later.

Many people also overlook the importance of including any required disclosures. West Virginia law mandates that sellers provide certain information about the property, such as known defects or environmental hazards. Failing to disclose this information can result in legal liability for the seller.

Lastly, some individuals do not seek legal advice before submitting the agreement. This can be a critical mistake. Consulting with a legal professional can help identify potential issues and ensure that the agreement complies with state laws. Taking this step can protect your interests and facilitate a smoother transaction.

Key takeaways

When filling out and using the West Virginia Real Estate Purchase Agreement form, there are several important considerations to keep in mind. Understanding these key takeaways can help ensure a smooth transaction.

- Accuracy is Crucial: Every detail in the agreement must be accurate. This includes names, property addresses, and financial terms. Errors can lead to disputes or delays.

- Understand Contingencies: The agreement often includes contingencies, such as financing or inspections. Familiarize yourself with these clauses to protect your interests.

- Review Deadlines: Pay close attention to deadlines for inspections, financing, and closing. Missing these dates can jeopardize the transaction.

- Consult Professionals: It is advisable to consult with a real estate agent or attorney before finalizing the agreement. Their expertise can provide valuable insights.

- Document Everything: Keep copies of all signed documents and correspondence related to the transaction. This can be essential for future reference or in case of disputes.