Attorney-Verified West Virginia Rental Application Template

When seeking a place to call home in West Virginia, prospective tenants will encounter the rental application form, a critical document that serves as a gateway to securing a lease. This form typically requires personal information, including the applicant's name, contact details, and social security number, which landlords use to assess the suitability of potential renters. Financial history is also a key component; applicants must provide details about their income, employment, and credit history. Additionally, references from previous landlords or personal contacts may be requested to vouch for the applicant's reliability and character. The form often includes questions about pets, smoking habits, and any prior evictions, allowing landlords to gauge compatibility with their property rules. Understanding the nuances of this application process can empower renters, ensuring they present themselves in the best light while navigating the competitive housing market in West Virginia.

Some Other West Virginia Forms

Employee Handbook Creation - Learn about promotion opportunities within the company.

West Virginia Local Income Taxes - This form may be required for financial transactions, like loans.

For individuals considering liability protection, understanding a Hold Harmless Agreement is vital to ensure safety and legal clarity during events or activities. You can learn more about this important legal form by visiting the comprehensive guide on the Hold Harmless Agreement found here.

Notary Acknowledgement Sample - Notary Acknowledgements can prevent fraud by confirming the signer’s identity.

Misconceptions

Understanding the West Virginia Rental Application form is essential for both landlords and tenants. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

- All rental applications are the same. Many people believe that rental applications are uniform across the country. In reality, each state, including West Virginia, has specific requirements and forms.

- Landlords cannot ask for personal information. Some tenants think that landlords cannot request personal details. However, landlords often need this information to assess an applicant's suitability.

- A rental application guarantees approval. Many assume that submitting an application means they will automatically be approved. Approval depends on various factors, including credit history and rental references.

- Only credit scores matter. While credit scores are important, landlords also consider income, rental history, and other factors when evaluating applications.

- Application fees are illegal. Some individuals believe that charging an application fee is against the law. In West Virginia, landlords can charge a reasonable fee to cover the costs of processing the application.

- All applicants are treated equally. It is a common misconception that all applications are evaluated in the same way. Landlords may have different criteria based on their individual policies.

- Once submitted, applications cannot be withdrawn. Many think that an application cannot be retracted after submission. In fact, applicants can often withdraw their applications before a decision is made.

- Landlords must provide a reason for denial. Some believe that landlords are required to explain why an application was denied. While it is good practice to provide feedback, it is not a legal requirement in all cases.

- Rental applications are only for new tenants. Many think rental applications are only necessary for first-time tenants. Existing tenants may also need to fill out a new application if they are renewing or transferring leases.

- Submitting an application is the same as signing a lease. Some people confuse the application process with signing a lease. An application is merely a request for tenancy, while a lease is a legally binding agreement.

By clarifying these misconceptions, both landlords and tenants can navigate the rental application process more effectively.

West Virginia Rental Application: Usage Instruction

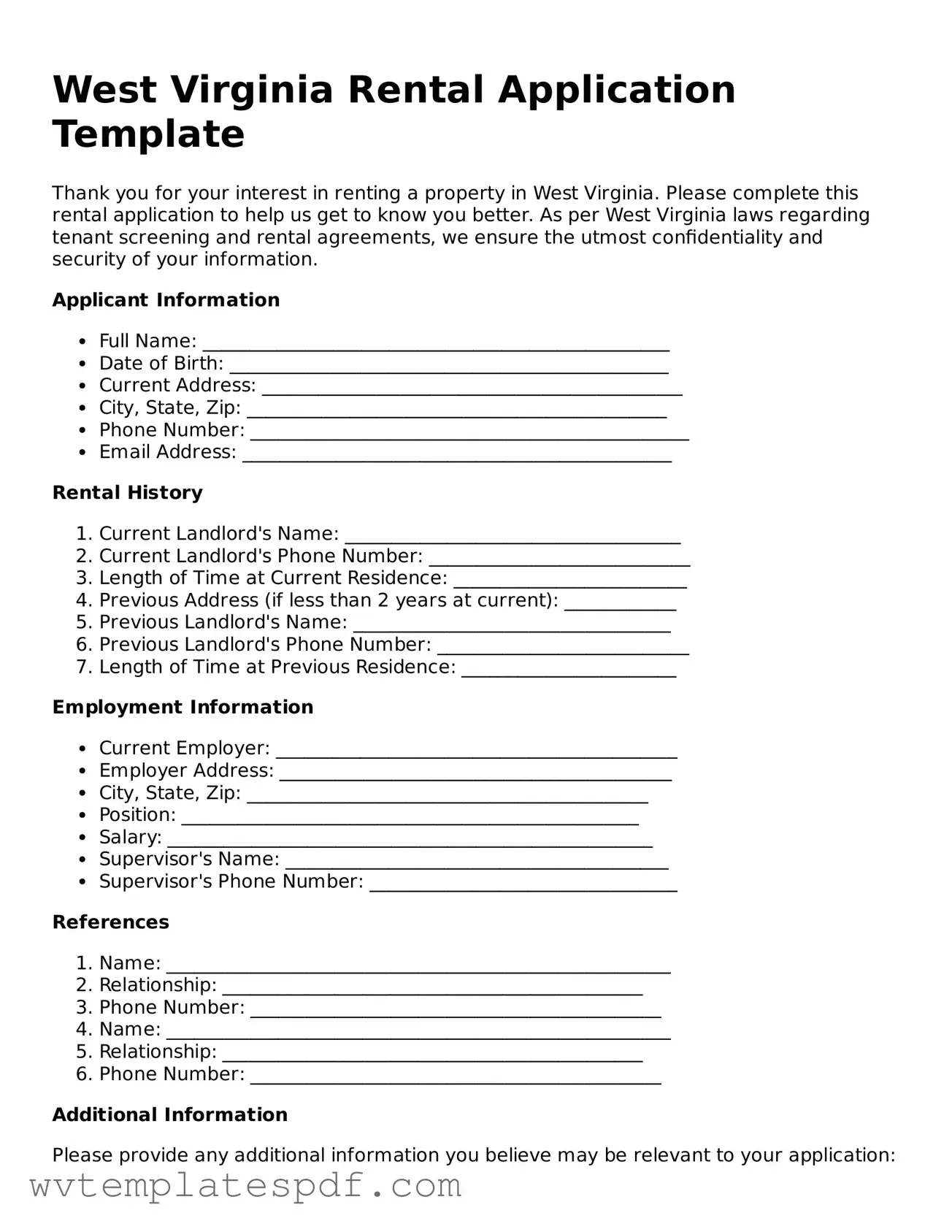

Filling out a rental application is an essential step in securing a place to live. Once you have the form ready, you will need to provide accurate information to ensure a smooth application process. Here’s how to complete the West Virginia Rental Application form effectively.

- Begin with your personal information. Fill in your full name, date of birth, and Social Security number.

- Provide your current address. Include the street address, city, state, and zip code.

- List your previous addresses. Include at least the last two years of residency, with dates and landlord contact information.

- Detail your employment history. Include your current employer's name, address, and your position. Also, add your income and how long you've been employed there.

- Provide references. This may include personal or professional contacts who can vouch for your character and reliability.

- Complete any additional sections. This may involve questions about pets, smoking preferences, or other specific requirements.

- Review your application for accuracy. Ensure all information is correct and complete to avoid delays.

- Sign and date the application. This confirms that all information provided is truthful.

After completing the application, submit it to the landlord or property management company along with any required fees. Be prepared for a background check and possible follow-up questions.

Similar forms

- Credit Application: This document collects personal and financial information to evaluate a person's creditworthiness. Like a rental application, it requires details about income and employment.

- Bill of Sale Form: To simplify your property transactions, refer to the detailed Georgia bill of sale form guidelines for accurate documentation and compliance.

- Job Application: A job application asks for personal information, work history, and references. Both forms aim to assess qualifications and reliability.

- Loan Application: Similar to a rental application, a loan application gathers financial information to determine eligibility for borrowing money. It includes income, debts, and credit history.

- Membership Application: This document is used for joining organizations or clubs. It often requests personal details and reasons for joining, much like a rental application seeks to understand the applicant's background.

- Lease Agreement: While a lease agreement is a contract for renting property, it includes similar personal information about the tenant, including names and contact details, akin to those found in a rental application.

- Insurance Application: An insurance application collects personal and health-related information to assess risk. Like a rental application, it evaluates the applicant's history and reliability.

- Background Check Form: This form is used to gather information for screening purposes. It often includes personal history and references, similar to what is required in a rental application.

Documents used along the form

When applying for a rental property in West Virginia, several forms and documents may accompany the Rental Application. These documents help landlords evaluate potential tenants and ensure a smooth leasing process.

- Credit Report: This document provides insight into the applicant's credit history, including payment patterns and outstanding debts. Landlords often use it to assess financial responsibility.

- Background Check Authorization: This form allows landlords to conduct a background check on the applicant. It typically includes consent for checking criminal records, rental history, and other relevant information.

- Notice to Quit: Understanding the implications of the Arizona PDFs form is crucial for tenants facing eviction, as it clearly communicates the landlord's intentions and timelines for vacating the property.

- Income Verification: Applicants may need to submit proof of income, such as pay stubs or tax returns. This document confirms the applicant's ability to afford the rent.

- Rental History Verification: This document outlines the applicant's previous rental experiences. It may include contact information for former landlords and details about payment history and lease compliance.

- Pet Policy Agreement: If applicable, this form outlines the rules and conditions regarding pet ownership in the rental property. It often includes fees, breed restrictions, and other related policies.

Having these documents ready can facilitate the application process and demonstrate preparedness to potential landlords. Proper documentation can lead to a more favorable rental outcome.

Common mistakes

Filling out a rental application can seem straightforward, but many people make common mistakes that can jeopardize their chances of securing a rental property. One frequent error is incomplete information. Applicants often skip sections or leave questions blank, thinking that minor details won’t matter. However, landlords look for thoroughness and attention to detail. Providing all requested information shows responsibility and increases the likelihood of approval.

Another mistake is failing to provide accurate contact information. When applicants list incorrect phone numbers or email addresses, it can create communication barriers. Landlords may need to reach out for clarification or to offer a lease. If they can't contact you, they may move on to the next applicant.

Many people also underestimate the importance of credit history. Some applicants may not disclose negative aspects of their credit report, thinking it won’t be checked. However, landlords often conduct credit checks. Being upfront about any issues can build trust and may lead to more favorable considerations, such as a co-signer or a higher deposit.

Another common mistake involves not providing references. Failing to include personal or professional references can raise red flags for landlords. References help establish reliability and can provide insights into an applicant's character. It’s wise to think ahead and gather references before filling out the application.

Additionally, some applicants neglect to read the application thoroughly. Overlooking specific requirements or terms can lead to misunderstandings later. For instance, some landlords may have unique stipulations regarding pets or smoking. Understanding these terms before applying can save time and avoid disappointment.

Finally, many individuals forget to proofread their application. Simple typos or grammatical errors can make an application look careless. Taking a moment to review the application can enhance professionalism and make a positive impression. Attention to detail reflects well on an applicant’s character and reliability.

Key takeaways

When filling out and using the West Virginia Rental Application form, keep these key takeaways in mind:

- Personal Information: Provide accurate personal details, including your full name, contact information, and social security number.

- Employment History: Include your current and previous employment information. This helps landlords verify your income and stability.

- Rental History: List your previous addresses. Be prepared to provide references from past landlords if requested.

- Credit Check: Understand that many landlords will run a credit check. Ensure your credit report is in good standing before applying.

- Income Verification: Be ready to provide proof of income. This could include pay stubs, bank statements, or tax returns.

- Application Fee: Some landlords charge a non-refundable application fee. Make sure to check this before submitting your application.

- Honesty is Key: Always provide truthful information. Misrepresenting facts can lead to denial of your application or eviction later.

- Follow Up: After submitting your application, follow up with the landlord or property manager to show your interest and check on the status.