Attorney-Verified West Virginia Small Estate Affidavit Template

Navigating the complexities of estate management can be a daunting task, especially when dealing with the passing of a loved one. In West Virginia, the Small Estate Affidavit offers a streamlined process for settling the affairs of individuals who have left behind modest estates. This form is particularly beneficial for estates that do not exceed a certain value, allowing heirs to bypass the often lengthy and costly probate process. By using the Small Estate Affidavit, heirs can claim assets such as bank accounts, personal property, and other belongings without the need for formal court intervention. The form requires specific information, including the names of the decedent and heirs, a description of the assets, and an affirmation that the estate qualifies under state guidelines. It is essential to understand the eligibility criteria and the necessary documentation to ensure a smooth transition of assets. With the right approach, this legal tool can simplify what is often a complicated and emotional journey for families during a challenging time.

Some Other West Virginia Forms

Sell Vehicle - It is important for both parties to sign the Bill of Sale to validate the transaction.

Completing the Florida Sales Tax form accurately is crucial for businesses operating in the state, as it ensures compliance with state tax regulations. For those looking for the necessary template and information required to file correctly, they can find it at floridaforms.net/blank-florida-sales-tax-form/, which serves as a valuable resource for understanding the requirements associated with the Sales and Use Tax Return DR-15CS.

Wv Dmv Title Transfer - In case of a loan, the Bill of Sale may be required by the lender for processing the mortgage.

Misconceptions

Understanding the West Virginia Small Estate Affidavit form is crucial for managing small estates efficiently. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- Only heirs can use the Small Estate Affidavit. Many believe that only heirs are eligible. In fact, anyone with a legitimate claim to the estate can use this form.

- The Small Estate Affidavit is only for estates under a specific dollar amount. While there is a limit, it’s important to know that the threshold can change. Always check the current regulations.

- All debts must be paid before using the affidavit. This is not entirely true. The affidavit can be used even if some debts are outstanding, but the estate must be able to cover them.

- The form is only for real estate. Many think it applies solely to real property. However, the Small Estate Affidavit can be used for personal property as well.

- Filing the affidavit is the same as going through probate. This is a common misconception. The affidavit is a simplified process and does not involve the full probate court proceedings.

- All assets must be listed on the affidavit. Some believe every asset must be detailed. In reality, only those assets that fall under the small estate limit need to be included.

- The affidavit can be filed at any time. Many think timing doesn’t matter. However, there are specific timelines that must be adhered to after the decedent’s death.

- Using the Small Estate Affidavit is always quicker than probate. While it is generally faster, complications can arise that may delay the process.

Being aware of these misconceptions can help individuals navigate the Small Estate Affidavit process more effectively. Always consider consulting with a professional for guidance tailored to your specific situation.

West Virginia Small Estate Affidavit: Usage Instruction

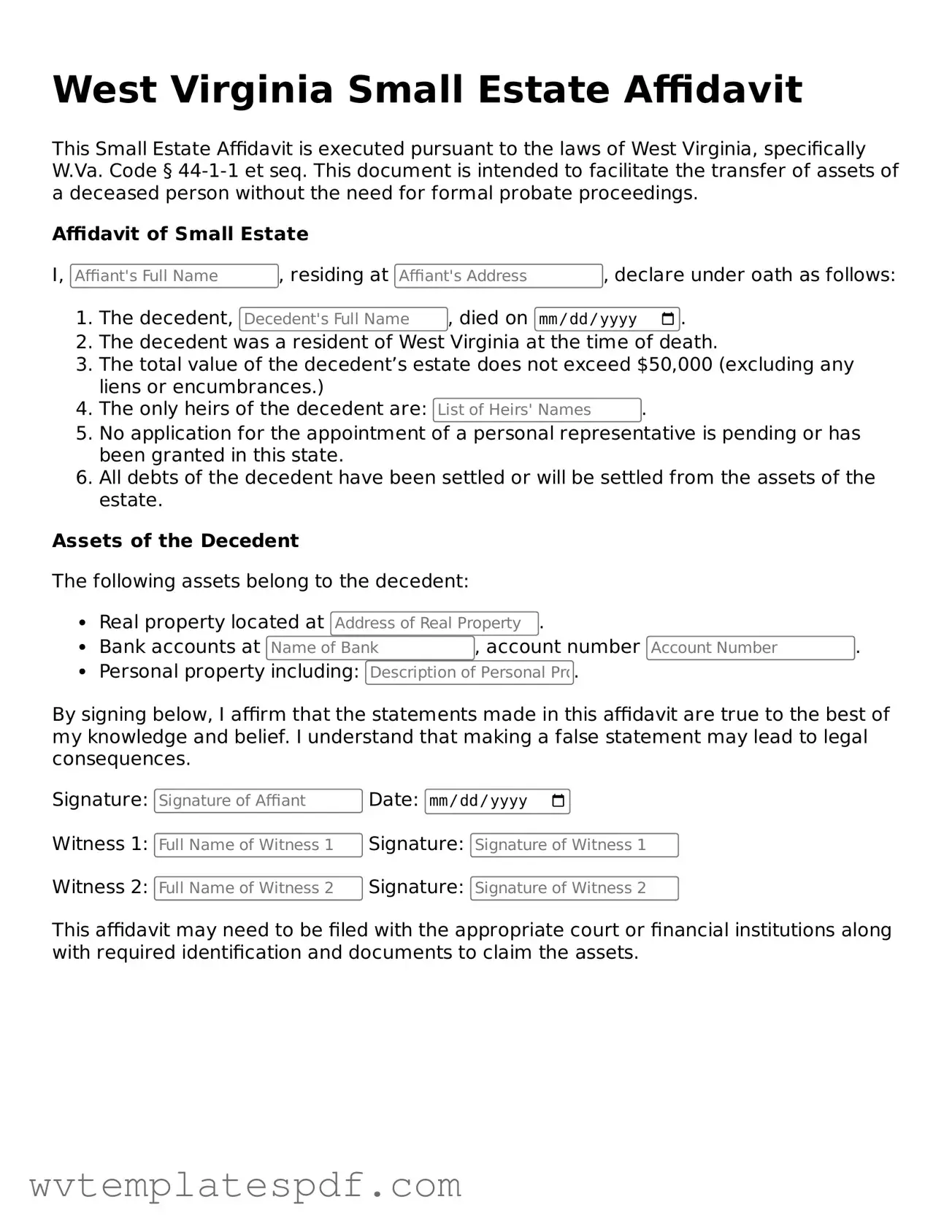

After gathering all necessary information and documents, you are ready to fill out the West Virginia Small Estate Affidavit form. This form allows individuals to claim property from a deceased person's estate without going through the formal probate process. Follow these steps to complete the form accurately.

- Obtain the Small Estate Affidavit form. You can find it online or at your local courthouse.

- Enter the name of the deceased individual at the top of the form.

- Provide the date of death of the deceased. This information is crucial for establishing eligibility.

- List the names and addresses of all heirs or beneficiaries. Ensure that this information is complete and accurate.

- Detail the assets of the deceased. Include real estate, bank accounts, and any other property that falls under the estate.

- Indicate the total value of the estate. Make sure this amount does not exceed the state limit for small estates.

- Sign the affidavit in front of a notary public. This step is essential for validating the document.

- Make copies of the completed affidavit for your records and for the heirs.

Once the form is filled out and notarized, you can present it to the relevant institutions or agencies to claim the assets. Ensure you keep a copy of the affidavit for your personal records.

Similar forms

- Last Will and Testament: This document outlines a person's wishes regarding the distribution of their assets after death. Like the Small Estate Affidavit, it helps in transferring property to heirs but requires probate to be validated.

- Probate Petition: A formal request to a court to validate a will and appoint an executor. Similar to the Small Estate Affidavit, it deals with asset distribution but typically involves a longer legal process.

- Letters Testamentary: Issued by a court, these letters grant an executor the authority to manage a deceased person's estate. Both documents serve to facilitate asset transfer, but Letters Testamentary require probate.

- California ATV Bill of Sale: This form is essential for documenting the transfer of ownership for ATVs in California. It includes critical details such as buyer and seller information, vehicle identification number, and purchase price, making it a valuable resource for both parties involved in the sale. For more information, visit California Templates.

- Trust Document: A legal arrangement where a trustee holds assets for beneficiaries. Like the Small Estate Affidavit, it can simplify the transfer of assets, but it operates independently of probate.

- Affidavit of Heirship: This document establishes a person's heirs without going through probate. It shares similarities with the Small Estate Affidavit in that it helps clarify ownership of assets.

- Transfer on Death Deed: This deed allows property to pass directly to a beneficiary upon death, avoiding probate. Both documents aim to simplify asset transfer but differ in their application and requirements.

- Declaration of Homestead: This document protects a person's home from creditors. Like the Small Estate Affidavit, it can provide benefits to heirs, but it focuses specifically on homeownership protection.

- Beneficiary Designation Forms: These forms allow individuals to name beneficiaries for specific accounts or policies. Both documents facilitate asset transfer upon death, but they apply to different types of assets.

Documents used along the form

The West Virginia Small Estate Affidavit form is often accompanied by several other documents to ensure a smooth process in settling an estate. Each of these forms serves a specific purpose and helps clarify the details surrounding the estate. Below is a list of common documents that may be used alongside the Small Estate Affidavit.

- Death Certificate: This official document confirms the death of the individual whose estate is being settled. It is a crucial piece of evidence needed to initiate the estate administration process.

- Will: If the deceased left a will, it should be included. The will outlines the distribution of the deceased's assets and may provide insight into their wishes regarding the estate.

- List of Heirs: This document identifies all individuals entitled to inherit from the estate. It typically includes names, addresses, and relationships to the deceased.

- Affidavit of Heirship: This sworn statement may be necessary to establish the heirs of the deceased, especially if there is no will. It provides legal backing to the claims of the heirs.

- Power of Attorney Form: This document is vital for appointing someone to make decisions on your behalf. Understanding how to properly execute this form is essential, and you can find a helpful resource at Arizona PDFs.

- Inventory of Assets: A detailed list of the deceased's assets is essential. This inventory helps determine the value of the estate and what is to be distributed among the heirs.

- Tax Documents: Any tax returns or documents related to the deceased's financial affairs should be included. These may be necessary for settling debts and ensuring compliance with tax obligations.

- Court Filings: Depending on the case, there may be additional court documents required to validate the Small Estate Affidavit. These can include petitions or notices filed with the court.

Gathering these documents is important for a successful and efficient estate settlement process. Each form plays a vital role in ensuring that the wishes of the deceased are honored and that the legal requirements are met.

Common mistakes

Filling out the West Virginia Small Estate Affidavit form can be straightforward, but many individuals make common mistakes that can delay the process or even invalidate the affidavit. One frequent error is failing to provide accurate information about the decedent. This includes the full legal name, date of death, and last known address. Omitting or misrepresenting this information can lead to complications in settling the estate.

Another common mistake involves not listing all assets. The Small Estate Affidavit is meant for estates with limited assets, but it is crucial to include every relevant asset. Individuals often overlook personal property or bank accounts, which can result in legal issues down the line. Be thorough when compiling this information.

Many people also neglect to check the eligibility requirements for using the Small Estate Affidavit. In West Virginia, the total value of the estate must not exceed a certain threshold. Failing to confirm this can lead to the affidavit being rejected. It is essential to understand these limits before proceeding.

Signatures are another area where mistakes frequently occur. The affidavit must be signed by the appropriate parties, typically the heirs or beneficiaries. Sometimes, individuals forget to include all necessary signatures, or they may not sign in the correct location. This oversight can invalidate the document.

Additionally, individuals often misinterpret the need for notarization. The Small Estate Affidavit must be notarized to be legally binding. Failing to have the document notarized can result in delays and additional paperwork. Always ensure that the affidavit is properly notarized before submission.

Misunderstanding the role of witnesses is another mistake. In West Virginia, the affidavit may require witnesses depending on the circumstances. Some individuals overlook this requirement, which can complicate the process. It is important to be aware of whether witnesses are necessary in your specific case.

People sometimes provide incorrect information about their relationship to the decedent. The affidavit requires clear identification of the relationship, whether as a spouse, child, or other relative. Misrepresenting this relationship can lead to disputes among heirs and beneficiaries.

Another error involves not providing supporting documentation. While the Small Estate Affidavit itself is a legal document, it often requires additional paperwork, such as death certificates or proof of relationship. Omitting these documents can slow down the estate settlement process.

Lastly, individuals may fail to retain copies of the completed affidavit. Keeping a copy is vital for personal records and for any future legal requirements. Without a copy, individuals may face challenges if questions arise later regarding the estate.

Key takeaways

When dealing with the West Virginia Small Estate Affidavit form, there are several important points to keep in mind. Here are key takeaways to help you navigate the process:

- Eligibility: The Small Estate Affidavit is available for estates valued at $50,000 or less for individuals and $100,000 or less for married couples.

- Purpose: This form allows heirs to claim assets without going through a lengthy probate process.

- Filing Requirements: You must file the affidavit in the county where the deceased person lived at the time of their death.

- Affidavit Contents: The form requires information about the deceased, including their name, date of death, and details of the assets.

- Signature: The affidavit must be signed by the person claiming the assets, affirming that the information provided is true.

- Witnesses: At least one witness must sign the affidavit, confirming the identity of the affiant.

- Asset Distribution: The affidavit should outline how the assets will be distributed among the heirs.

- Tax Considerations: Be aware of potential tax implications for the estate and the heirs when claiming assets.

- Legal Advice: While the process can be straightforward, consulting with a lawyer can provide clarity and ensure compliance with state laws.

Understanding these key points will make the process of using the West Virginia Small Estate Affidavit smoother and more efficient.