Attorney-Verified West Virginia Transfer-on-Death Deed Template

In West Virginia, the Transfer-on-Death Deed (TODD) offers a straightforward way for property owners to pass their real estate to designated beneficiaries without the need for probate. This form allows individuals to retain full control of their property during their lifetime while ensuring a smooth transfer upon their death. One of the key features of the TODD is that it can be revoked or changed at any time before the owner’s passing, providing flexibility to adapt to changing circumstances. It is important to note that the deed must be properly executed and recorded with the county clerk to be valid. Additionally, the TODD does not affect the property owner’s rights to sell, mortgage, or otherwise manage the property while they are alive. Understanding these aspects can help property owners make informed decisions about their estate planning and ensure their wishes are honored after they pass away.

Some Other West Virginia Forms

Wv Lease - The agreement includes the duration of the lease, usually measured in months or years.

When selling or purchasing an ATV in California, having the right documentation is crucial for a smooth transaction. For this purpose, you can rely on the California Templates to provide you with a comprehensive Bill of Sale form that ensures all necessary details are captured properly, offering peace of mind to both the buyer and the seller.

What Does a Dnr Mean - Your DNR should be easily accessible to ensure it can be followed when needed.

Sell Vehicle - A Bill of Sale can include specifics on the method of delivery for the sold items.

Misconceptions

Understanding the West Virginia Transfer-on-Death Deed (TODD) can help ensure that your property is transferred smoothly upon your passing. However, several misconceptions exist about this legal tool. Here’s a list of common misunderstandings:

- It automatically transfers property upon signing. Many believe that simply signing the TODD means the property is transferred immediately. In reality, the transfer only occurs after the owner's death.

- All properties can be transferred using a TODD. Some think any type of property is eligible for a TODD. However, certain properties, like those held in a trust or jointly owned with rights of survivorship, cannot be transferred this way.

- It replaces a will. A common myth is that a TODD eliminates the need for a will. While it does facilitate the transfer of specific property, it does not cover all assets and does not replace a comprehensive estate plan.

- It avoids all probate issues. People often assume that a TODD completely avoids probate. While it can simplify the process for the property it covers, other assets may still require probate.

- Once filed, it cannot be changed. Some believe that a TODD is set in stone once it’s filed. In fact, property owners can revoke or modify the deed at any time before their death.

- It is only for married couples. There is a misconception that only married couples can use a TODD. In truth, anyone can utilize this deed to transfer property to their chosen beneficiaries.

- Beneficiaries can access the property before the owner dies. Many think that beneficiaries can take control of the property while the owner is still alive. However, beneficiaries do not gain any rights until the owner passes away.

By clarifying these misconceptions, individuals can make informed decisions about their estate planning in West Virginia.

West Virginia Transfer-on-Death Deed: Usage Instruction

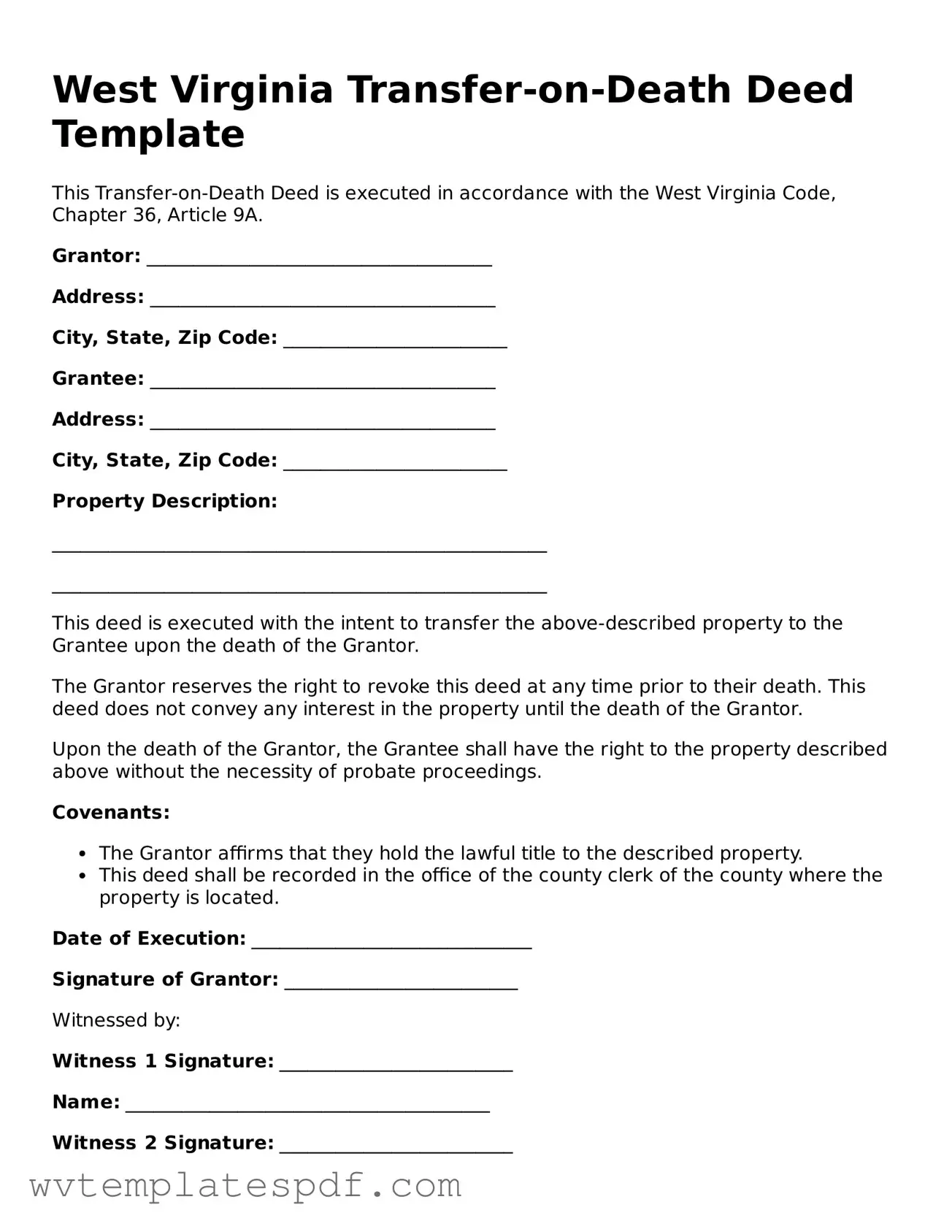

After obtaining the West Virginia Transfer-on-Death Deed form, you will need to complete it accurately to ensure proper transfer of property upon death. Follow these steps carefully to fill out the form correctly.

- Begin by entering your name as the grantor in the designated space at the top of the form.

- Provide your address, including city, state, and ZIP code, right below your name.

- Identify the property you wish to transfer. Include the complete legal description, which can be found in your property deed.

- Next, list the name of the beneficiary who will receive the property. Ensure that you spell their name correctly.

- Include the beneficiary's address below their name, providing city, state, and ZIP code.

- If there are multiple beneficiaries, repeat the previous two steps for each one, ensuring clarity in identification.

- Sign and date the form in the designated area. Make sure to do this in front of a notary public.

- Have the notary public sign and seal the document to validate it.

- Finally, file the completed deed with the appropriate county clerk’s office where the property is located.

Similar forms

- Will: A will is a legal document that outlines how a person's assets will be distributed upon their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries for their property. However, a will typically requires probate, while a Transfer-on-Death Deed does not.

- Living Trust: A living trust is established during a person's lifetime and allows for the management of assets. Similar to a Transfer-on-Death Deed, it can facilitate the transfer of property upon death without going through probate. Both documents aim to simplify the transfer process for beneficiaries.

- Joint Tenancy: Joint tenancy is a form of property ownership where two or more people hold title to an asset together. Upon the death of one owner, the property automatically passes to the surviving owner(s), similar to how a Transfer-on-Death Deed allows for the direct transfer of property to named beneficiaries.

- Beneficiary Designation: This document is often used for financial accounts, such as life insurance policies and retirement accounts. It allows individuals to name beneficiaries who will receive the assets directly upon their death, much like a Transfer-on-Death Deed does for real estate.

- Notice to Quit: The Arizona PDFs form is a critical document that landlords utilize to notify tenants of the need to vacate the rental premises, detailing the eviction reasons and timelines to ensure compliance with legal standards.

- Payable-on-Death (POD) Accounts: A POD account allows individuals to designate a beneficiary who will receive the funds in the account upon the account holder's death. This process mirrors the Transfer-on-Death Deed in that it facilitates a straightforward transfer of assets without the need for probate.

Documents used along the form

The West Virginia Transfer-on-Death Deed (TOD) is a valuable tool for estate planning, allowing property owners to transfer real estate to beneficiaries without going through probate. Along with this deed, several other documents may be necessary to ensure a smooth transfer process. Below are some commonly used forms and documents associated with the TOD deed.

- Last Will and Testament: This document outlines how a person wishes their assets to be distributed upon their death. It can include provisions for the same property covered by the TOD deed.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for accounts such as life insurance policies and retirement accounts, ensuring that assets pass directly to named individuals.

- Power of Attorney: This legal document grants someone the authority to act on behalf of another person in financial or legal matters. It can be crucial if the property owner becomes incapacitated.

- Affidavit of Heirship: This document is often used to establish the identity of heirs and their rights to inherit property when someone dies without a will.

- Property Title Documents: These documents provide proof of ownership and are necessary for transferring property. They may include the original deed and any related documents that show the property's history.

- Florida Marriage Application Form: Couples wishing to legalize their union in Florida need to complete this form, which is a essential step before acquiring a marriage license. More information can be found here: https://floridaforms.net/blank-florida-marriage-application-form.

- Deed of Distribution: This document is used to formally transfer property from an estate to the beneficiaries after the owner's death, particularly when the property was not covered by a TOD deed.

Understanding these documents can help individuals navigate the complexities of property transfer and estate planning. Proper preparation can prevent disputes and ensure that wishes are honored after one's passing.

Common mistakes

Filling out a Transfer-on-Death (TOD) Deed in West Virginia can be a straightforward process, but there are common mistakes that individuals often make. These errors can lead to confusion or even legal complications down the line. Understanding these pitfalls can help ensure that the deed is completed correctly and serves its intended purpose.

One frequent mistake is failing to include all required information. The form requires specific details such as the names and addresses of both the grantor and the beneficiary. Omitting any of this information can render the deed invalid. It’s essential to double-check that all fields are filled out completely before submission.

Another common error is not properly identifying the property. The deed must clearly describe the property being transferred. This includes the legal description, which can often be found on the property’s current deed. Using vague descriptions can lead to disputes later on, so precision is key.

People also sometimes forget to sign the deed. In West Virginia, the grantor must sign the document in the presence of a notary public. Not obtaining a notarization can invalidate the deed, making it crucial to follow this step carefully.

Additionally, individuals may overlook the need for witnesses. In some cases, having witnesses sign the deed can add an extra layer of validity. Failing to include witnesses when required can complicate the transfer process later.

Another mistake is neglecting to record the deed with the appropriate county clerk’s office. After completing the form, it must be filed with the local government to ensure that the transfer is legally recognized. Skipping this step can leave the property in a state of limbo.

People often misinterpret the implications of the TOD Deed. Some assume that it operates like a will, but it is important to understand that the TOD Deed transfers ownership immediately upon the grantor's death. This distinction can impact estate planning strategies, so clarity on this point is vital.

Furthermore, individuals may not consider the tax implications of a Transfer-on-Death Deed. While the transfer can avoid probate, it may still have tax consequences that need to be addressed. Consulting with a tax professional can provide insight into any potential liabilities.

Lastly, many overlook the importance of updating the deed after significant life events. Changes such as marriage, divorce, or the death of a beneficiary necessitate a review and possible revision of the deed. Keeping the document current ensures that it reflects the grantor's wishes accurately.

By being aware of these common mistakes, individuals can approach the completion of the West Virginia Transfer-on-Death Deed with confidence. Taking the time to fill out the form correctly can prevent future complications and ensure a smooth transfer of property.

Key takeaways

When considering a Transfer-on-Death Deed (TODD) in West Virginia, it’s important to understand the key aspects of the process. Here are some essential takeaways:

- The Transfer-on-Death Deed allows property owners to transfer their real estate to a designated beneficiary upon their death, without the need for probate.

- To be valid, the TODD must be signed by the property owner and notarized. This ensures that the deed is legally binding.

- It’s crucial to clearly identify the beneficiary or beneficiaries in the deed. Ambiguities can lead to disputes later on.

- The deed must be recorded with the county clerk's office where the property is located. This step is necessary for the transfer to take effect.

- Property owners can revoke or change the TODD at any time during their lifetime, providing flexibility in estate planning.

Understanding these points can help ensure a smoother transition of property and peace of mind for both the owner and their beneficiaries.