Fill a Valid West Virginia Cd 3 Form

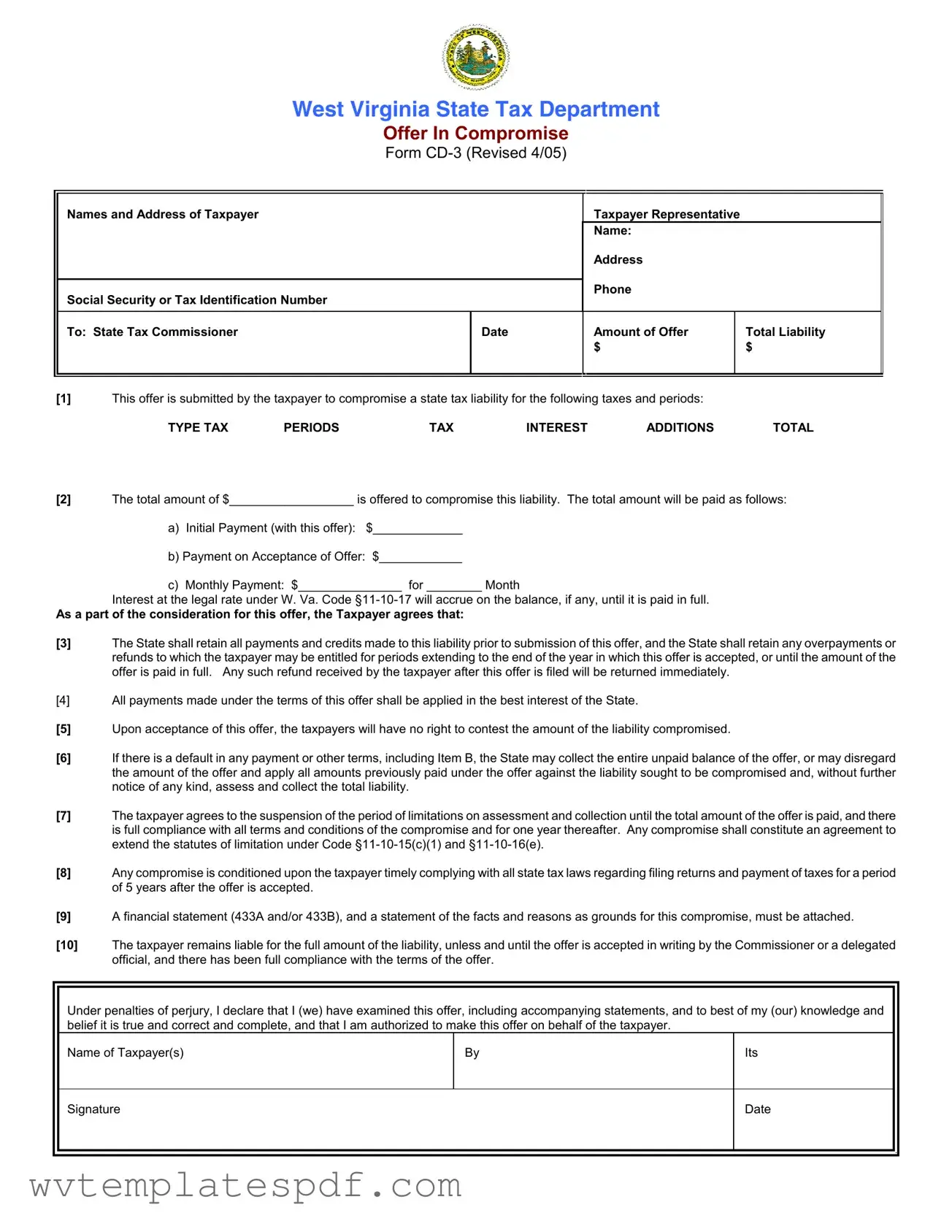

The West Virginia CD-3 form is a crucial document for taxpayers seeking to resolve their state tax liabilities through an Offer in Compromise. This form allows individuals to propose a reduced amount to settle their tax debts, provided they can demonstrate that full payment is unlikely. The CD-3 form requires detailed information about the taxpayer, including their name, address, and identification number, along with a comprehensive breakdown of the tax liabilities being compromised. Taxpayers must specify the total liability, including taxes, interest, and any additional charges, and outline their proposed payment plan. This plan typically includes an initial payment, a payment upon acceptance of the offer, and monthly installments. It is essential to understand that submitting this form does not automatically halt collection efforts; taxpayers must continue to comply with all state tax laws and file necessary returns. The form also emphasizes the importance of transparency, requiring taxpayers to attach a financial statement and a narrative explaining the grounds for their compromise offer. By adhering to these guidelines, taxpayers can work towards a resolution that benefits both themselves and the state.

Other PDF Forms

Social Studies Fair - Make sure your bibliography includes all necessary details to make it easy for others to find your sources.

To facilitate a smooth transaction when buying or selling an ATV, it's essential to use a formalized process, ensuring all necessary documentation is in order. For your convenience, you can find a standard template to use for this purpose at California Templates, which provides clear guidelines and an organized format to help both parties meet the legal requirements.

Wv Refund - Taxpayers can submit the OPT-1 when they believe their situation does not fit electronic filing criteria.

West Virginia Court - Each form and section is meticulously detailed to guide users through the process seamlessly.

Misconceptions

Misconceptions about the West Virginia CD-3 form can lead to confusion for taxpayers. Here are four common misunderstandings:

- Misconception 1: Submitting the CD-3 form guarantees acceptance of the offer.

- Misconception 2: The offer must include the full amount of tax owed.

- Misconception 3: Filing the CD-3 form stops all collection actions.

- Misconception 4: The taxpayer is relieved of liability once the offer is submitted.

Many taxpayers believe that once they submit the CD-3 form, their offer will automatically be accepted. In reality, the State Tax Department evaluates each offer carefully. They consider factors such as the taxpayer's financial situation and the likelihood of collecting the full amount owed.

Some individuals think they need to offer the entire tax liability amount. However, the purpose of the CD-3 form is to propose a compromise based on what the taxpayer can realistically pay. The State is interested in collecting what is potentially collectible, not necessarily the full amount.

Taxpayers often assume that submitting the CD-3 form halts all collection efforts. This is not true. The State may continue collection actions if they suspect the offer is a delay tactic or if prior agreements are still in place.

Many believe that submitting the CD-3 form absolves them of their tax liability. However, the taxpayer remains liable for the full amount until the offer is accepted in writing by the State Tax Commissioner, and all terms of the offer are met.

West Virginia Cd 3: Usage Instruction

Filling out the West Virginia CD-3 form is a crucial step in proposing a compromise for your state tax liability. After you submit the form, the State Tax Commissioner will review your offer and determine whether it meets the necessary criteria for acceptance. It’s essential to provide accurate information and follow the instructions carefully to enhance your chances of a successful outcome.

- Gather Required Information: Collect all necessary details, including your name, address, Social Security or Tax Identification Number, and any representative’s information if applicable.

- Complete Taxpayer Information: Fill in your name and address at the top of the form. If applicable, include the names of both spouses if filing jointly.

- Identify Tax Liabilities: In section (1), list all taxes, periods, interest, and any additions related to your liability. Be specific about each item.

- State Your Offer: In section (2), enter the total amount you are offering to compromise your tax liability. Break this down into three parts: initial payment, payment upon acceptance, and monthly payments.

- Detail Your Payment Plan: Clearly outline how you intend to make payments, including the amounts and duration of monthly payments.

- Attach Required Documentation: Include a financial statement (Form 433-A and/or 433-B) and a detailed explanation of why your offer should be accepted.

- Sign and Date the Form: Ensure that you, and any other taxpayer involved, sign and date the form. If someone else is signing on your behalf, attach a power of attorney.

- Submit the Form: File the completed CD-3 form with the Compliance Division. If you have been working with a specific employee, submit it directly to them.

Similar forms

- IRS Form 656: This form is used for submitting an Offer in Compromise to the Internal Revenue Service. Like the West Virginia CD-3, it allows taxpayers to propose a settlement for their tax liabilities based on the inability to pay the full amount owed.

- California Form OIC: The California Offer in Compromise form serves a similar purpose at the state level. Taxpayers can negotiate their tax debts with the California Franchise Tax Board, much like the process outlined in the West Virginia CD-3.

- New York Form OIC: This document allows New York taxpayers to settle their tax debts with the state. Similar to the West Virginia CD-3, it requires taxpayers to provide financial information and a rationale for their offer.

- Florida Form DR-501: This form is used for submitting an offer in compromise for Florida state taxes. It parallels the West Virginia CD-3 by allowing taxpayers to propose a lower amount to resolve their tax obligations.

- Arizona Notice to Quit: This legal document informs tenants they must vacate the rental property. It is important for landlords and tenants to understand this form, as it outlines reasons for eviction and timelines for leaving, which can be further understood through resources like Arizona PDFs.

- Texas Offer in Compromise Application: Texas taxpayers can use this application to negotiate their tax liabilities. It shares similarities with the West Virginia CD-3 in that it requires a detailed financial statement and a clear offer amount.

- Illinois Form OIC: The Illinois Offer in Compromise form allows taxpayers to resolve their tax debts at a reduced amount. The requirements for financial documentation and the rationale for the offer are akin to those in the West Virginia CD-3.

- Pennsylvania Form REV-1706: This form is used to propose an offer in compromise to the Pennsylvania Department of Revenue. Like the West Virginia CD-3, it involves submitting financial information and a statement of reasons for the compromise.

- Ohio Offer in Compromise Form: Ohio taxpayers can submit this form to negotiate their tax debts. It is similar to the West Virginia CD-3 in that it requires the taxpayer to demonstrate their inability to pay the full amount owed.

- Massachusetts Offer in Compromise: This form is used by Massachusetts taxpayers to settle their tax liabilities. It mirrors the West Virginia CD-3 by allowing taxpayers to propose a compromise based on financial hardship.

- Virginia Offer in Compromise Application: Virginia's form for Offer in Compromise allows taxpayers to propose settling their tax debts at a reduced amount. The process and requirements are similar to those outlined in the West Virginia CD-3.

Documents used along the form

The West Virginia CD-3 form is an essential document for taxpayers seeking to settle their state tax liabilities through an offer in compromise. However, several other forms and documents often accompany this submission to ensure a complete and effective application. Below is a list of these important documents.

- Form 433-A (Collection Information Statement for Individuals): This form provides a detailed overview of an individual's financial situation, including income, expenses, assets, and liabilities. It is crucial for the state to assess the taxpayer's ability to pay and determine the reasonableness of the offer.

- Form 433-B (Collection Information Statement for Businesses): Similar to Form 433-A, this document is tailored for businesses. It collects information about the business's financial health, including revenue, expenses, and assets, helping the state evaluate the offer's feasibility.

- Power of Attorney (if applicable): If someone other than the taxpayer is submitting the offer, a power of attorney must accompany the CD-3 form. This document authorizes the representative to act on behalf of the taxpayer in tax matters.

- Financial Documentation: Taxpayers must provide supporting documents that verify the information presented in Forms 433-A and 433-B. This may include bank statements, pay stubs, tax returns, and other financial records that substantiate claims about income and assets.

- Florida Marriage Application Form: Couples wishing to legalize their union in Florida must complete this form, which outlines the necessity of obtaining a license within 60 days of their intended wedding date and ensures that the license is valid only for ceremonies conducted within the state. Additional personal information is collected, essential for the administration of the marriage license. For more information, visit https://floridaforms.net/blank-florida-marriage-application-form/.

- Statement of Facts and Reasons: This narrative explains why the taxpayer believes the state should accept the offer. It should detail the reasons for the compromise, including any doubts about the taxpayer's liability or ability to pay the full amount.

- Tax Returns: All tax returns for the years in question must be filed before submitting the offer. The state requires these documents to ensure compliance with tax laws and assess the taxpayer's overall financial situation.

In summary, submitting the West Virginia CD-3 form involves more than just filling out the offer itself. Accompanying documents play a vital role in supporting the taxpayer's case for compromise. Each form and piece of documentation serves a specific purpose, helping to create a comprehensive picture of the taxpayer's financial circumstances and the rationale behind the offer. Ensuring that all necessary forms are completed accurately can significantly impact the outcome of the offer in compromise process.

Common mistakes

When filling out the West Virginia Offer in Compromise Form CD-3, individuals often make several common mistakes that can hinder their chances of a successful application. Understanding these errors can help taxpayers navigate the process more effectively.

One significant mistake is failing to provide complete and accurate personal information at the top of the form. This includes the taxpayer's full name, address, and taxpayer identification number. If the information is incomplete or incorrect, it can lead to delays or even rejection of the offer. It is essential to double-check this information to ensure it matches official records.

Another frequent error is neglecting to list all tax liabilities that are being compromised. In section (1) of the form, taxpayers must specify the types of tax, periods, and amounts. Omitting any of this information can create confusion and may result in the offer being deemed insufficient. Taxpayers should take care to provide a thorough breakdown of their liabilities.

Some individuals mistakenly include amounts that have already been paid or collected on their liabilities when stating the total amount offered in section (2). This section should reflect only the amount currently being offered to settle the debt. Miscalculating this figure can lead to rejection, as the state expects a realistic and fair offer based on the taxpayer's current financial situation.

In section (9), taxpayers often fail to provide a detailed explanation of why the state should accept their offer. This is a crucial part of the application. Without a well-articulated rationale, including facts and reasons supporting the claim of inability to pay more, the offer may not be taken seriously. It is advisable to attach additional pages if necessary to thoroughly explain the circumstances.

Another common oversight is not signing and dating the offer. The taxpayer must sign the form, and if someone else is signing on their behalf, a power of attorney must accompany the submission. Failing to include a signature can result in the offer being considered invalid.

Taxpayers also sometimes forget to include the required financial statements, specifically Form 433-A and/or Form 433-B. These forms provide critical information about the taxpayer's financial situation and must be completed in full. Incomplete forms can lead to delays or denials, as the state needs this information to evaluate the offer accurately.

Additionally, individuals may overlook the requirement for future compliance with tax laws. The offer is contingent upon the taxpayer adhering to all state tax laws for five years following acceptance. Ignoring this condition can lead to the offer being revoked, and the taxpayer may find themselves in a worse position than before.

Lastly, some taxpayers fail to understand that submitting the offer does not automatically halt collection efforts. If the state believes the offer is a tactic to delay payment, they may continue their collection actions. It is essential to be aware of this and to continue making any agreed-upon payments during the process.

By being mindful of these common mistakes, taxpayers can improve their chances of successfully navigating the West Virginia Offer in Compromise process. Attention to detail and a clear understanding of the requirements are key to achieving a favorable outcome.

Key takeaways

When filling out and using the West Virginia CD-3 form, there are several important considerations to keep in mind:

- Complete Identification: Ensure that your full name, address, and taxpayer identification number are correctly entered at the top of the form. If multiple taxpayers are involved, all names must be included.

- Specify Liabilities: Clearly list all tax liabilities you wish to compromise, including the types of tax, periods, and amounts. This information must be detailed in item (1) of the form.

- Offer Amount: The total amount you offer must be entered in item (2). This amount should not include any payments already made towards the liability.

- Payment Structure: Detail how the total offer will be paid. Include the initial payment, payment upon acceptance, and any monthly payment plans in the appropriate sections of item (2).

- Attach Necessary Documentation: A financial statement (Form 433-A and/or 433-B) must accompany the offer. This documentation should verify your financial situation and support your request for compromise.

- Compliance with Tax Laws: Future compliance with all state tax laws is required for five years after the offer is accepted. Failure to comply may result in the rejection of your offer.

- Understand the Consequences: By submitting the offer, you agree not to contest the liability amount if accepted. Additionally, overpayments or refunds will be forfeited until the compromise amount is paid in full.