Fill a Valid West Virginia Cf 1 Form

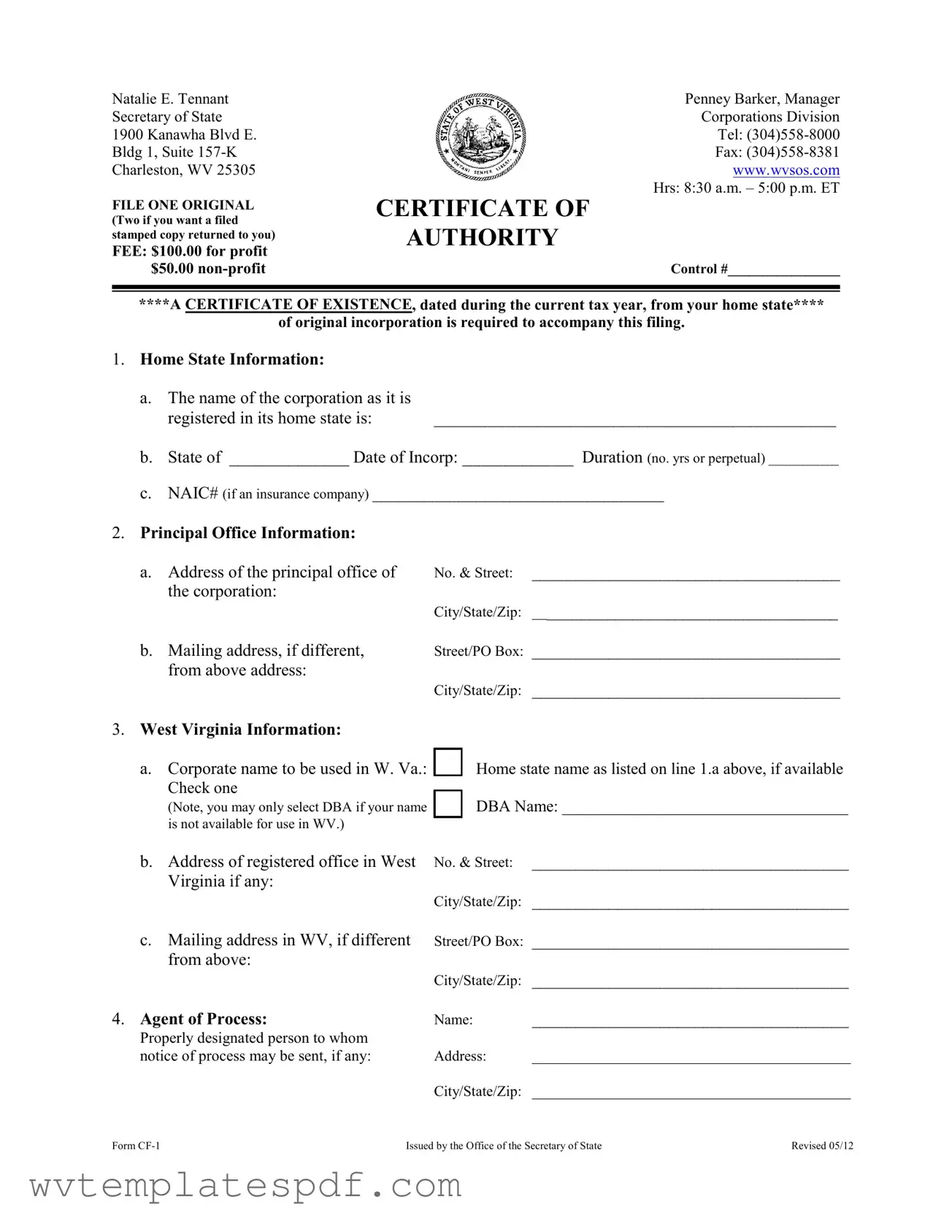

The West Virginia CF-1 form serves as a crucial instrument for corporations seeking to conduct business within the state. This application for a Certificate of Authority requires detailed information about the corporation's home state, including its name, date of incorporation, and duration. Applicants must also provide a Certificate of Existence, which verifies that the corporation is in good standing in its original state. The form necessitates the inclusion of the corporation's principal office address, as well as the designated registered office in West Virginia. Additionally, it prompts businesses to specify their purpose for operating in the state, whether they are for-profit or non-profit entities. Notably, if the corporation is a scrap metal dealer, additional registration forms must be completed. The CF-1 also requires the identification of a registered agent, who will receive legal documents on behalf of the corporation. Furthermore, the application includes sections for corporate officers and directors, as well as contact information, ensuring that all necessary parties are informed throughout the filing process. A filing fee of $100 for profit corporations or $50 for non-profits must accompany the application, along with any required supplementary documents. Overall, the CF-1 form embodies the regulatory framework that facilitates corporate activities in West Virginia while ensuring compliance with state laws.

Other PDF Forms

Wv Circuit Court Forms - Provide information about the respondents against whom the appeal is initiated.

A Power of Attorney (POA) form in Arizona is a legal document that allows one person to appoint another to make decisions on their behalf. This form can cover a wide range of matters, from financial transactions to healthcare decisions. Understanding the nuances of this document is crucial for anyone looking to ensure their wishes are honored when they can no longer speak for themselves. For a comprehensive guide, you can refer to Arizona PDFs.

West Virginia Cd 3 - It’s important for joint liabilities, such as married couples, to ensure both names are listed on the offer form.

Misconceptions

Understanding the West Virginia CF-1 form can be tricky, especially with the various misconceptions surrounding it. Here are ten common misunderstandings that people often have:

- Only for Profit Corporations: Many believe the CF-1 form is only applicable to profit corporations. In reality, both profit and non-profit organizations can use this form to obtain a Certificate of Authority in West Virginia.

- No Need for a Certificate of Existence: Some think they can submit the CF-1 without a Certificate of Existence from their home state. This certificate is mandatory and must be dated during the current tax year.

- One Application is Enough: A common myth is that submitting one application is sufficient. If you want a filed copy returned to you, you must submit two original applications.

- Corporate Name Must Match Exactly: People often assume that the corporate name on the CF-1 must match exactly with the home state registration. While it should be similar, you can use a “Doing Business As” (DBA) name if the original is unavailable in West Virginia.

- Registered Agent Must Reside in West Virginia: There’s a belief that the agent for service of process must live in West Virginia. However, the agent can be a person or business that does not necessarily have a West Virginia address.

- Only Large Corporations Need to File: Some think that only large corporations need to fill out the CF-1. In truth, any corporation intending to conduct business in West Virginia, regardless of size, must file this form.

- Application Processing is Automatic: Many assume that once the CF-1 is submitted, it will automatically be processed. However, incomplete applications can be returned, leading to delays.

- Insurance Companies Have Different Rules: There’s a misconception that insurance companies don’t need to follow the same rules. In fact, they must adhere to additional requirements, including submitting a Certificate of Authority from the West Virginia Insurance Commissioner.

- Filing Fees are Fixed: Some believe that the filing fees are always the same. While the fees are $100 for profit and $50 for non-profit organizations, additional fees may apply based on land holdings or other factors.

- Signature is Optional: Lastly, people often think that the signature on the CF-1 is optional. In reality, the form must be signed by someone with authority to do so, and the date of signing is also required.

By clarifying these misconceptions, individuals and organizations can navigate the filing process more smoothly and ensure compliance with West Virginia’s regulations.

West Virginia Cf 1: Usage Instruction

Filling out the West Virginia CF-1 form is an important step in establishing your corporation's authority to operate in the state. By completing this form, you provide essential information about your business, ensuring compliance with local regulations. Here’s how to navigate the process smoothly.

- Gather Necessary Documents: Before you begin, make sure you have a Certificate of Existence from your home state, dated during the current tax year.

- Start with Home State Information: Fill in the name of your corporation as registered in your home state, the state of incorporation, the date of incorporation, and the duration of your corporation.

- Principal Office Information: Provide the street address, city, state, and ZIP code of your principal office. If you have a different mailing address, include that as well.

- West Virginia Information: Indicate the corporate name you wish to use in West Virginia. If your home state name is unavailable, select a "Doing Business As" (DBA) name.

- Registered Office Address: Enter the address of your registered office in West Virginia, along with a mailing address if it differs from the registered office.

- Agent of Process: Provide the name and address of the person designated to receive legal documents on behalf of your corporation.

- Business Purpose: Clearly state the proposed purpose(s) for conducting business in West Virginia.

- Scrap Metal Dealer Question: Indicate whether your business is a scrap metal dealer. If yes, you will need to complete an additional form.

- Email and Website: List a valid email address for future correspondence and include your business website address, if applicable.

- Corporate Status Information: Specify whether your corporation is for profit or non-profit. List all officers and directors along with their addresses.

- Land Holdings: Enter the number of acres of land your corporation holds or expects to hold in West Virginia.

- Contact and Signature Information: Provide a contact name and phone number. The signer should print their name, title, and sign the form with the date.

Once you've completed the CF-1 form, gather all required documents, including your Certificate of Existence and any additional forms needed. Make sure everything is signed and dated. Then, submit your application packet to the Secretary of State's office. Keep a copy for your records, and if you want a stamped copy returned, send two originals. This way, you ensure your application is processed efficiently!

Similar forms

Certificate of Good Standing: This document verifies that a corporation is authorized to conduct business in its home state. Like the CF-1 form, it requires information about the corporation's status and compliance with state laws.

Application for Certificate of Authority: Similar to the CF-1, this application is used by out-of-state corporations seeking to operate in another state. It collects information about the corporation's home state and its intended operations.

Articles of Incorporation: This foundational document establishes a corporation's existence. Both the Articles and the CF-1 require information about the corporation's name, purpose, and registered office.

Business License Application: This application is necessary for businesses to legally operate within a jurisdiction. It often parallels the CF-1 in that it collects information about the business's name and address.

Foreign Qualification Application: This document allows a corporation to operate in a state other than its state of incorporation. It shares similarities with the CF-1, focusing on the corporation's original state and its intended business activities.

DBA Registration Form: When a corporation wishes to operate under a different name, it must file a DBA registration. This form is similar to the CF-1 in that it requires the original corporate name and the new name being adopted.

Certificate of Existence: This document confirms that a corporation is in good standing and has complied with state requirements. It is often required alongside the CF-1 form for filing in West Virginia.

Annual Report: Corporations must file annual reports to maintain their status. Like the CF-1, this report includes information about the corporation's officers and business activities.

Registered Agent Appointment Form: This form designates a registered agent for service of process. It is similar to the CF-1 in that it requires the name and address of a designated person for legal notifications.

Hold Harmless Agreement: To mitigate liability in various activities, ensure you understand the specifics of the Hold Harmless Agreement process before proceeding.

Scrap Metal Dealer Registration Form (Form SMD-1): Required for businesses dealing in scrap metal, this form is similar to the CF-1 as it collects specific business information and requires compliance with state regulations.

Documents used along the form

When filing the West Virginia CF-1 form for a Certificate of Authority, there are several other important documents you may need. These forms help ensure that your application is complete and complies with state regulations. Here’s a brief overview of five commonly used forms that accompany the CF-1.

- Certificate of Existence: This document, often called a Certificate of Good Standing, is issued by the corporation's home state. It confirms that the corporation is legally registered and is in good standing, meaning it has met all necessary requirements and obligations.

- Scrap Metal Dealer Registration Form (Form SMD-1): If your business involves scrap metal dealing, you must complete this form. It provides specific information about your operations and ensures compliance with state regulations related to scrap metal transactions.

- Board Resolution for DBA Name: If your corporation's name from its home state is not available in West Virginia, a board resolution is required to adopt a "Doing Business As" (DBA) name. This document must be signed by the board of directors and outlines the approved name for use in the state.

- Florida Sales Tax Form (DR-15CS): To ensure compliance with Florida's tax regulations, businesses must file the floridaforms.net/blank-florida-sales-tax-form/ which details gross sales, exempt sales, and necessary tax calculations.

- Application to Appoint or Change Agent (Form AAO): If you need to designate or change the registered agent for your corporation in West Virginia, this form is necessary. The agent is the individual or business authorized to receive legal documents on behalf of your corporation.

- Certificate of Authority from the West Virginia Insurance Commissioner: For insurance companies, this certificate is crucial. It confirms that the insurance company is authorized to operate in West Virginia and must be submitted alongside the CF-1 form.

Gathering these documents will help streamline your application process and avoid delays. Ensure that each form is completed accurately and submitted with the CF-1 to meet West Virginia's requirements effectively.

Common mistakes

When filling out the West Virginia CF-1 form, individuals often overlook critical details that can lead to delays or outright rejections of their applications. One common mistake is failing to provide a valid Certificate of Existence from the home state of incorporation. This document must be current and dated within the same tax year as the application. Without it, the application will not be processed, as the Secretary of State requires this certificate to confirm that the corporation is in good standing in its home state.

Another frequent error involves the corporate name selection. Applicants may not check whether their desired name is available in West Virginia, leading to potential conflicts with existing businesses. The name must be distinguishable from others already registered. If the name is unavailable, applicants must submit a resolution from their board of directors adopting a different name for use in West Virginia. Not adhering to this requirement can result in immediate rejection of the application.

In addition, many people neglect to fill out the principal office information accurately. This section requires both the physical address and, if applicable, a different mailing address. Omitting or incorrectly entering this information can create confusion and delay the processing of the application. It is essential to ensure that all addresses are complete and correctly formatted to facilitate smooth communication with the Secretary of State’s office.

Lastly, applicants often forget to include the contact information for the person signing the application. While providing a contact name is optional, including one can expedite the process. If there are any issues or questions regarding the application, having a designated contact can help resolve matters more swiftly. Therefore, it is advisable to include a contact name, phone number, and title to avoid unnecessary delays.

Key takeaways

Filling out the West Virginia CF-1 form can seem daunting, but understanding a few key points can simplify the process. Here are some important takeaways to keep in mind:

- Original Copies: Always file one original of the CF-1 form. If you want a stamped copy returned to you, submit two originals.

- Fees: Be prepared to pay a fee of $100 for profit corporations and $50 for non-profit corporations.

- Certificate of Existence: A current Certificate of Existence from your home state is mandatory. Ensure it is dated within the current tax year.

- Name Availability: Check if your corporate name is available in West Virginia. If it's not, you may need to use a "Doing Business As" (DBA) name.

- Agent for Process: Designate a reliable person or business to receive legal notices. This agent does not need to have a West Virginia address.

- Purpose of Business: Clearly state the purpose of your business in West Virginia. This helps avoid confusion and ensures compliance with state regulations.

- Contact Information: Include a valid email address for correspondence and a contact person to expedite communication regarding your application.

By keeping these points in mind, you can navigate the CF-1 form with greater confidence. Taking the time to ensure accuracy and completeness will help facilitate a smoother application process.