Fill a Valid West Virginia Estimated Tax Form

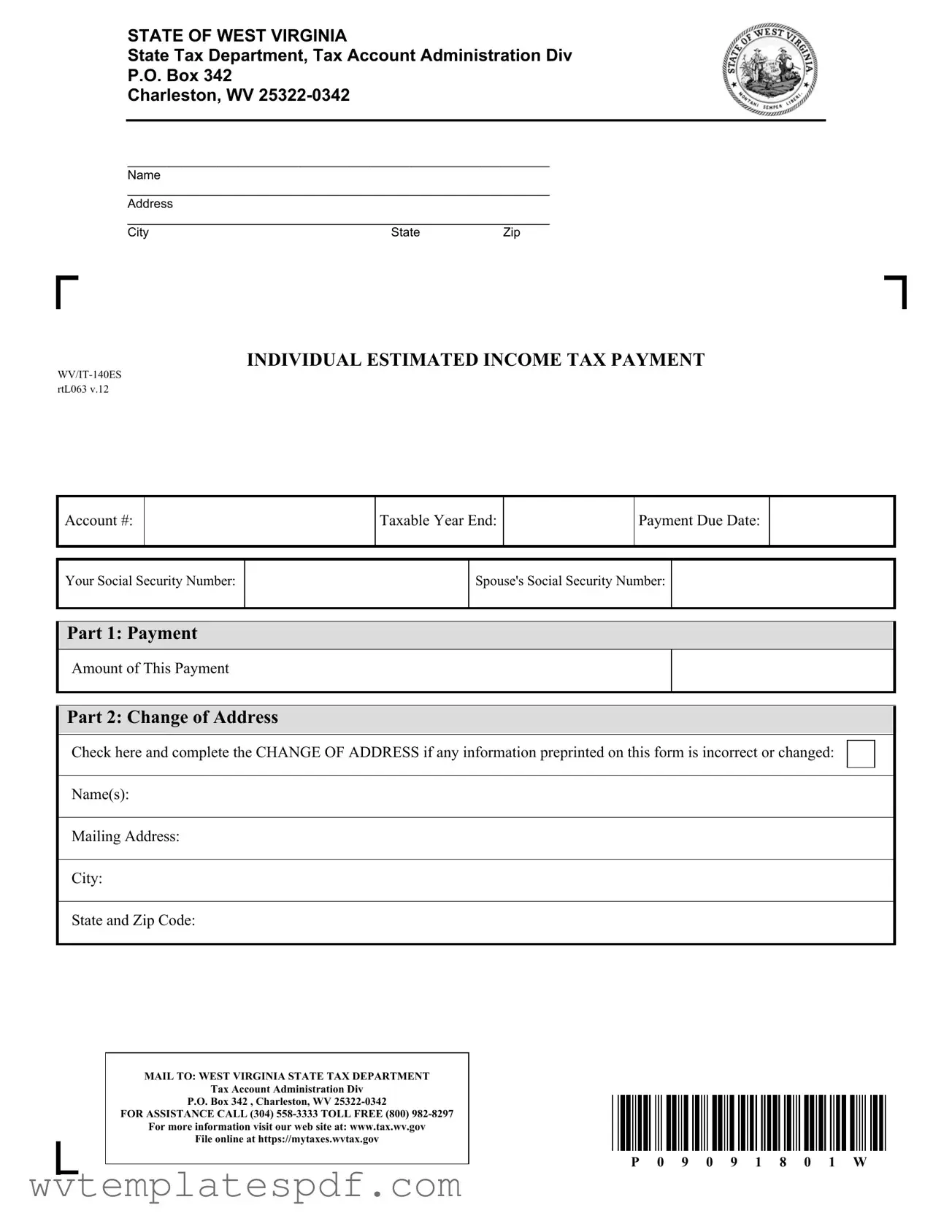

For individuals in West Virginia who anticipate owing at least $600 in state taxes when filing their annual income tax return, the West Virginia Estimated Tax form is an essential document. This form, known as WV/IT-140ES, is designed to help taxpayers make timely estimated tax payments throughout the year. It includes sections for personal information, such as your Social Security number and address, as well as the payment amount you are submitting. If any of your details have changed, the form provides a straightforward way to update your address. Additionally, it outlines the importance of calculating your estimated tax accurately, referencing the instruction brochure available on the West Virginia State Tax Department's website. To avoid penalties, it is crucial to meet the minimum payment requirements, but taxpayers have the option to pay more if they choose. Payments must be mailed to the designated address by the due date to ensure compliance. Understanding how to fill out this form correctly can alleviate stress and help you stay on top of your tax obligations.

Other PDF Forms

Wv Business Registration Certificate - Fees for land holdings exceeding 10,000 acres require additional payment of 5 cents per acre over the limit.

Understanding the nuances of the Florida Sales Tax form is essential for businesses to ensure compliance with state regulations, and for those looking for the official document, it can be found online at https://floridaforms.net/blank-florida-sales-tax-form. By accurately filling out the Sales and Use Tax Return DR-15CS, businesses can effectively report their sales and manage their tax obligations.

West Virginia Cd 3 - Any arguments for the offer must be compelling as to why it is in the state’s best interest to consider the proposal.

West Virginia Court - Importantly, failure to comply with the filling deadlines may complicate the administration process.

Misconceptions

Many individuals have misunderstandings about the West Virginia Estimated Tax form. Here are eight common misconceptions, along with clarifications to help you navigate the process more effectively.

- Estimated tax payments are only for the wealthy. This is not true. Anyone who expects to owe at least $600 in state tax when filing their annual return must make estimated payments, regardless of income level.

- You can ignore estimated tax payments if you are employed. Many employees mistakenly believe that their employer's withholding covers all tax obligations. However, if you have additional income, such as freelance work or investments, you may still need to make estimated payments.

- It’s okay to skip payments if you can’t pay the full amount. While it’s understandable to be concerned about financial constraints, skipping payments can lead to penalties. It’s better to pay at least the minimum amount calculated to avoid these penalties.

- All taxpayers use the same payment schedule. Not all taxpayers are on a calendar year. If you are not a calendar year taxpayer, you should refer to the specific instructions to determine your payment due dates.

- Estimated payments are not necessary if you have a refund from the previous year. A refund does not eliminate your obligation to make estimated payments. If you expect to owe at least $600 this year, you still need to pay estimated taxes.

- You can submit your payment anytime before the due date. While payments can be made up until the due date, it’s important to ensure they are mailed well in advance to avoid any delays that could result in penalties.

- Only one payment is required for the entire year. This is incorrect. Estimated tax payments are typically made quarterly, so you need to plan for multiple payments throughout the year.

- Once you make an estimated payment, you don’t need to track your income. It’s crucial to monitor your income and tax situation throughout the year. Changes in your income may require adjustments to your estimated payments.

Understanding these misconceptions can help you fulfill your tax obligations more effectively and avoid unnecessary penalties. If you have any doubts or need assistance, consider reaching out to the West Virginia State Tax Department for guidance.

West Virginia Estimated Tax: Usage Instruction

Filling out the West Virginia Estimated Tax form involves several straightforward steps. This form is necessary for individuals who expect to owe a certain amount in state taxes. Completing the form accurately ensures timely processing and helps avoid penalties.

- Obtain the West Virginia Estimated Tax form (WV/IT-140ES) from the West Virginia State Tax Department's website or other official sources.

- Locate your personal information on the form. Fill in your name, address, and Social Security number. If applicable, include your spouse's Social Security number.

- Identify the taxable year and the payment due date. This information can typically be found on the form or in the instructions.

- Determine your estimated tax amount using the instruction brochure (Form IT-140ESI) available at www.tax.wv.gov.

- Enter the payment amount in Part 1 of the form. Ensure this amount meets or exceeds the minimum calculated to avoid penalties.

- If your address has changed or any preprinted information is incorrect, check the box for a change of address. Complete the required fields with your updated information.

- Review the completed form for accuracy. Make sure all fields are filled out correctly.

- Mail the completed form to the West Virginia State Tax Department at the address provided: P.O. Box 342, Charleston, WV 25322-0342.

For assistance, you can call the West Virginia State Tax Department at (304) 558-3333 or toll-free at (800) 982-8297. Additional information is also available on their website.

Similar forms

-

The IRS Form 1040-ES is similar to the West Virginia Estimated Tax form. Both documents are used by individuals to calculate and pay estimated taxes throughout the year. Taxpayers use these forms when they expect to owe a certain amount of tax at the end of the year, ensuring they stay compliant with tax obligations.

-

The California Estimated Tax Payment Voucher (Form 540-ES) shares similarities with the West Virginia form. Like the West Virginia form, it allows California residents to estimate and pay their state taxes in advance. Both forms help taxpayers avoid penalties for underpayment.

-

The New York State Estimated Income Tax Payment Voucher (Form IT-2105) serves a similar purpose. This form is used by New York residents to make estimated tax payments based on their expected income tax liability. Just as with the West Virginia form, it is essential for avoiding penalties related to underpayment.

-

The NYCERS F266 form is crucial for Tier 3 and Tier 4 members of the New York City Employees' Retirement System to request their Vested Retirement Benefit. For more details, visit https://nyforms.com.

-

The Florida Estimated Tax Payment Form also mirrors the West Virginia Estimated Tax form. While Florida does not have a state income tax, this form is used for other taxes like corporate income tax. Taxpayers in both states must make estimated payments to ensure compliance with tax laws.

Documents used along the form

The West Virginia Estimated Tax form is an important document for individuals who expect to owe state taxes. When filing this form, you may also need to prepare additional documents to ensure a complete and accurate tax filing. Below is a list of commonly used forms and documents that may accompany the Estimated Tax form.

- West Virginia Individual Income Tax Return (WV/IT-140): This is the main form used to report your income and calculate your tax liability for the year. It is filed annually and reconciles any estimated payments made throughout the year.

- Estimated Tax Payment Instructions (Form IT-140ESI): This brochure provides detailed guidance on how to calculate your estimated tax payments. It includes worksheets and examples to help you determine your tax obligation.

- West Virginia Change of Address Form: If you have moved since your last tax filing, this form allows you to update your address with the state tax department. Keeping your information current is essential for receiving important tax documents.

- Payment Voucher (WV/IT-140ESV): When making estimated tax payments, you may need to include a payment voucher. This document helps the tax department process your payment correctly and ensures it is applied to your account.

- Power of Attorney Form: This legal document allows individuals to appoint someone to make decisions on their behalf, ensuring their wishes are honored when they can no longer speak for themselves. For more information, visit Arizona PDFs.

- W-2 Forms: If you are employed, your W-2 forms report your annual wages and the taxes withheld from your paycheck. These forms are crucial for accurately completing your income tax return.

- 1099 Forms: If you receive income from sources other than employment, such as freelance work or investments, you will receive 1099 forms. These documents report various types of income and must be included in your tax return.

- Supporting Documentation for Deductions: If you plan to claim deductions on your tax return, gather relevant documents like receipts, invoices, or statements. This documentation supports your claims and may be required if the tax department requests verification.

- Tax Payment Records: Keep records of all estimated tax payments made throughout the year. This includes receipts or bank statements that confirm your payments, which will help you reconcile your tax obligations.

Being organized and prepared with these documents can simplify your tax filing process and help you avoid potential penalties. Make sure to review each form carefully and consult with a tax professional if you have questions about your specific situation.

Common mistakes

Filling out the West Virginia Estimated Tax form can be straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is failing to accurately calculate the estimated tax amount. Individuals must determine their expected tax liability for the year. If this calculation is incorrect, it could result in underpayment penalties. It's crucial to refer to the instruction brochure (Form IT-140ESI) for guidance on how to compute this figure correctly.

Another common mistake is neglecting to check for preprinted information accuracy. The form may contain prefilled details such as the taxpayer's name, address, or Social Security number. If any of this information is incorrect, it should be updated in the section provided. Failing to do so can cause delays in processing and potential issues with tax records.

Some individuals overlook the payment table section of the form. It is important to post the payment amount in the designated area. This step ensures that the payment is properly recorded and credited to the taxpayer's account. Without this, there may be confusion regarding the payment status, leading to unnecessary follow-up communications with the tax department.

Additionally, many taxpayers forget to consider their filing status when completing the form. The instructions specify different guidelines for individuals who are not calendar year taxpayers. Those who fall into this category must pay attention to the specific due dates for their estimated payments. Missing these deadlines can result in penalties and interest charges.

Another mistake involves not mailing the form to the correct address. The completed form and payment should be sent to the West Virginia State Tax Department, specifically to the Tax Account Administration Division. Using the wrong address can lead to delays in processing and may affect the taxpayer's compliance status.

Lastly, some individuals fail to seek assistance when needed. The West Virginia State Tax Department provides a contact number for inquiries. If there are uncertainties about filling out the form or calculating the estimated tax, reaching out for help can prevent errors and ensure compliance with state tax laws. Taking the time to verify information and seek guidance can save taxpayers from potential issues down the line.

Key takeaways

Here are some key takeaways about filling out and using the West Virginia Estimated Tax form:

- Eligibility: You must make estimated tax payments if you expect to owe at least $600 in state tax when filing your annual income tax return.

- Form Usage: Use the West Virginia Estimated Tax form (WV/IT-140ES) to report your estimated tax payments.

- Payment Amount: Calculate your estimated tax amount using the instruction brochure (Form IT-140ESI) available on the state tax website.

- Minimum Payment: To avoid penalties, ensure your payment meets the minimum amount calculated according to the instructions.

- Additional Payments: You can pay more than the minimum if you choose to do so.

- Payment Table: Record your payment in the designated payment table on the form.

- Due Dates: If you are not a calendar year taxpayer, check the instructions for specific due dates for your payments.

- Mailing Instructions: Send your completed form and payment to the West Virginia State Tax Department at the specified address.

- Assistance: For help, you can call the provided toll-free number or visit the state tax website for more information.