Fill a Valid West Virginia Gsr 01 Form

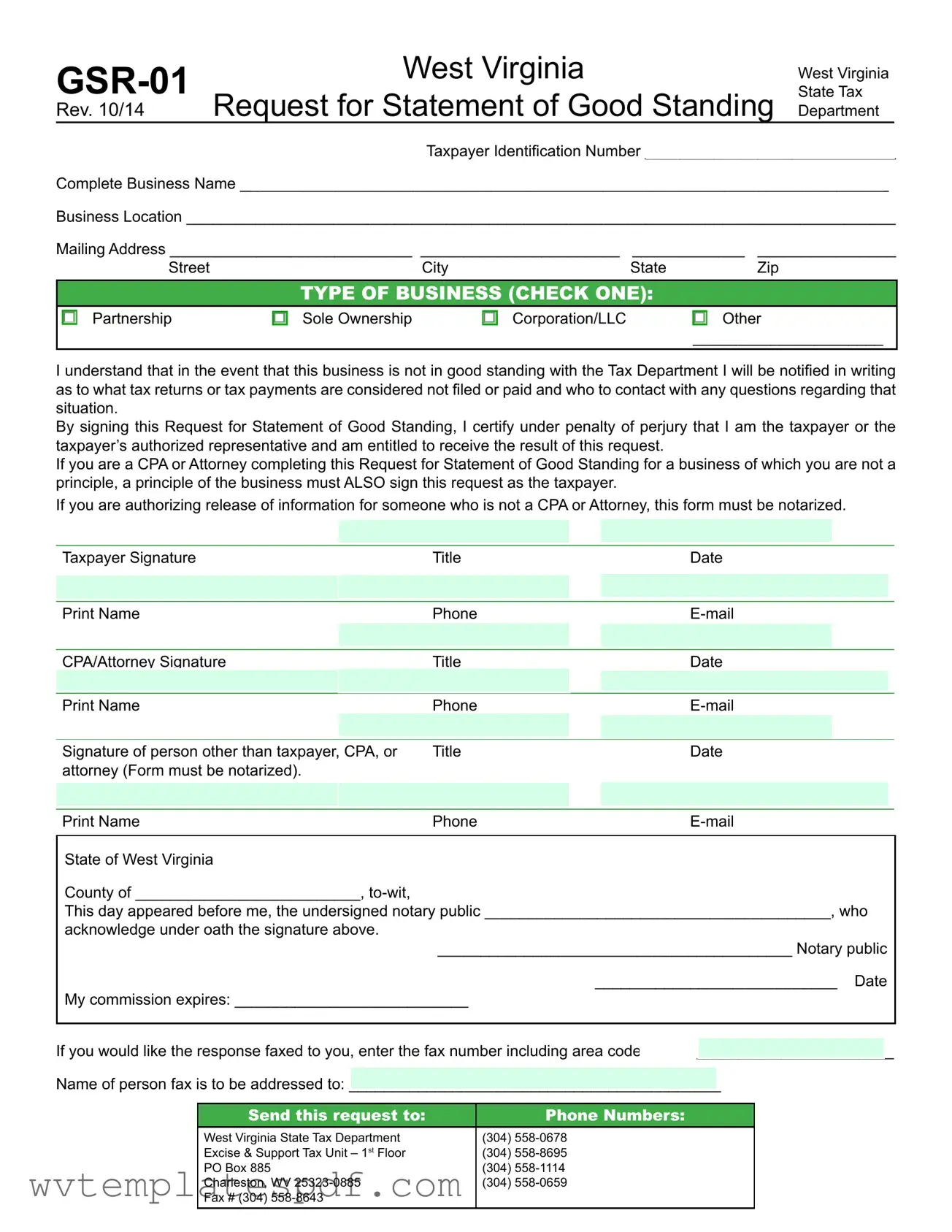

The West Virginia GSR-01 form, officially known as the Request for Statement of Good Standing, serves as an essential document for businesses operating in the state. This form is crucial for verifying that a business is compliant with state tax regulations. It requires the completion of key details, including the taxpayer identification number, business name, and business location. Additionally, it prompts the filer to indicate the type of business entity—whether a partnership, sole proprietorship, corporation, or limited liability company. Understanding the implications of this form is vital; if a business is not in good standing, the Tax Department will notify the applicant about any outstanding tax returns or payments. The form also emphasizes the importance of signatures, requiring both the taxpayer and, if applicable, their authorized representative to sign. If someone other than the taxpayer is completing the form, notarization is necessary. This ensures that the request is legitimate and that the information provided is accurate. Finally, the form includes options for receiving the response, highlighting the importance of communication with the West Virginia State Tax Department.

Other PDF Forms

Wv Tax Forms - Estimated tax forms can also be filed online through West Virginia’s tax website.

For those looking to understand the implications of a critical Hold Harmless Agreement form, it is important to note how this document serves as a safeguard against liability. Knowledge of this agreement will empower participants to make informed decisions when engaging in activities that carry risk.

West Virginia Cd 3 - Timeliness in submitting the form along with the offer payments is crucial to avoid rejection by the state.

Wv Business Registration Certificate - Additional pages may be attached if there are more officers and directors to list.

Misconceptions

Misconceptions about the West Virginia GSR-01 form can lead to confusion and delays in obtaining necessary documentation. Here are eight common misunderstandings:

- The GSR-01 form is only for corporations. Many believe this form is exclusive to corporations. In reality, it is applicable to various business types, including partnerships and sole proprietorships.

- Only the business owner can submit the form. While the business owner typically submits the form, an authorized representative can also do so. However, they must ensure the owner’s signature is included.

- The form guarantees a good standing status. Submitting the GSR-01 form does not automatically guarantee that the business is in good standing. It merely requests a statement regarding the current status.

- Notarization is always required. Notarization is only necessary if someone other than the taxpayer, CPA, or attorney is completing the form. In such cases, the form must be notarized.

- The form can be submitted without a Taxpayer Identification Number (TIN). A TIN is essential for processing the request. Without it, the form may be rejected.

- Response times are immediate. Many assume that they will receive a response right away. However, processing times can vary, so it is wise to plan accordingly.

- Faxing the request is not an option. Some believe they must mail the form. In fact, the form can be faxed to the appropriate department, provided the sender includes the correct fax number.

- There are no consequences for inaccurate information. Providing false information on the GSR-01 form can lead to penalties, including potential legal repercussions. Accuracy is crucial.

West Virginia Gsr 01: Usage Instruction

Completing the West Virginia GSR-01 form is essential for obtaining a Statement of Good Standing for your business. This process involves providing specific information about your business and ensuring that the form is signed appropriately. Follow these steps to fill out the form correctly.

- Obtain the GSR-01 form from the West Virginia State Tax Department's website or office.

- Enter your Taxpayer Identification Number in the designated space at the top of the form.

- Fill in your complete Business Name accurately.

- Provide the Business Location, including the street address, city, state, and zip code.

- Complete the Mailing Address section with your street address, city, state, and zip code.

- Select the type of business by checking the appropriate box: Partnership, Sole Ownership, Corporation/LLC, or Other. If you choose "Other," specify the type.

- Read the statement regarding good standing and ensure you understand the implications.

- Sign the form in the Taxpayer Signature section, and include your title and date.

- Print your name, phone number, and email address in the designated areas.

- If applicable, have the CPA or Attorney sign in the appropriate section, including their title, date, and contact information.

- If someone other than the taxpayer is signing, ensure that their signature is notarized and that the notary public completes their section.

- If you wish to receive a fax response, provide the fax number and the name of the person to whom it should be addressed.

- Submit the completed form to the West Virginia State Tax Department via mail or fax.

Similar forms

- Certificate of Good Standing: This document serves a similar purpose by confirming that a business is legally registered and compliant with state requirements. It is often required for business transactions, such as applying for loans or entering contracts.

- Business License: A business license indicates that a company has been granted permission by the local government to operate. Like the GSR-01 form, it verifies compliance with local regulations and can be essential for legal operations.

- Georgia Bill of Sale Form: To ensure the proper transfer of personal property, refer to the detailed Georgia bill of sale form guide for complete documentation.

- Tax Clearance Certificate: This certificate verifies that a business has paid all its taxes and is in good standing with the tax authorities. It shares similarities with the GSR-01 form in that both documents address tax compliance.

- Articles of Incorporation: These documents establish a corporation's existence and outline its basic structure. While the GSR-01 form focuses on tax standing, Articles of Incorporation provide foundational legal information about the business.

- Operating Agreement: For LLCs, this document outlines the management structure and operating procedures. While it does not address tax standing directly, it is essential for demonstrating the legitimacy and operational framework of the business, similar to the purpose of the GSR-01 form.

Documents used along the form

When dealing with the West Virginia GSR-01 form, several other documents may also be needed to ensure compliance and proper processing. Each document serves a specific purpose and helps facilitate the request for a Statement of Good Standing. Below are some commonly used forms and documents associated with the GSR-01.

- Business Registration Certificate: This document proves that a business is officially registered with the state. It contains the business name, registration number, and type of business entity.

- Tax Clearance Certificate: This certificate indicates that a business has no outstanding tax liabilities with the state. It provides assurance that all taxes have been filed and paid.

- Operating Agreement: For LLCs, this document outlines the management structure and operational procedures of the business. It is essential for clarifying roles and responsibilities among members.

- Bylaws: Corporations typically use bylaws to govern their internal management. This document includes rules for meetings, voting, and the appointment of officers.

- Power of Attorney: If someone other than the business owner is handling the request, a Power of Attorney form may be required. This document grants authority to the representative to act on behalf of the business. For a comprehensive template, you can refer to Arizona PDFs.

- Power of Attorney: If someone other than the business owner is handling the request, a Power of Attorney form may be required. This document grants authority to the representative to act on behalf of the business.

Having these documents ready can streamline the process and help ensure that your request for a Statement of Good Standing is handled efficiently. It’s important to review each document carefully and ensure all information is accurate and complete.

Common mistakes

Filling out the West Virginia GSR-01 form can seem straightforward, but many people make common mistakes that can delay processing or lead to rejection. One frequent error is leaving out the Taxpayer Identification Number. This number is crucial for identifying your business with the state tax department. Without it, your request may not be processed, and you could face unnecessary delays in obtaining your Statement of Good Standing.

Another common mistake involves the business name. It is essential to ensure that the complete business name is accurately filled in. Any discrepancies between the name provided on the GSR-01 form and the name registered with the state can lead to confusion and may result in a denial of your request. Double-checking this information before submission can save you time and hassle.

People often overlook the requirement for signatures. If you are not the taxpayer or an authorized representative, the form must be signed by a principal of the business. Additionally, if the request is being made by someone who is not a CPA or attorney, the form must be notarized. Failing to meet these signature requirements can lead to rejection of the form, causing further delays in your request.

Lastly, many individuals forget to include a contact method for receiving the response. Whether you prefer a fax or email, specifying this information is crucial. If you do not provide a way for the tax department to reach you, you may miss important communications regarding your business's standing. Always ensure that this section is completed to facilitate smooth communication.

Key takeaways

Here are some key takeaways about filling out and using the West Virginia GSR-01 form:

- Understand the purpose: The GSR-01 form is a request for a Statement of Good Standing from the West Virginia State Tax Department.

- Gather necessary information: Before filling out the form, collect your Taxpayer Identification Number and complete business name.

- Specify your business type: You must check the appropriate box to indicate whether your business is a Partnership, Sole Ownership, Corporation/LLC, or Other.

- Provide accurate addresses: Include both your business location and mailing address to ensure proper communication.

- Read the notification clause: The form states that if your business is not in good standing, you will be notified about any unpaid tax returns or payments.

- Signatures are crucial: The taxpayer or their authorized representative must sign the form to certify its accuracy.

- Additional signatures: If a CPA or attorney completes the form for a business, a principal of that business must also sign.

- Notarization requirements: If someone other than the taxpayer, CPA, or attorney is signing, the form must be notarized.

- Include contact details: Provide a phone number and email for follow-up or clarification regarding your request.

- Fax options: If you prefer a fax response, include the fax number and the name of the person to whom it should be addressed.

Following these steps will help ensure that your request for a Statement of Good Standing is processed smoothly and efficiently.