Fill a Valid West Virginia It 140X Form

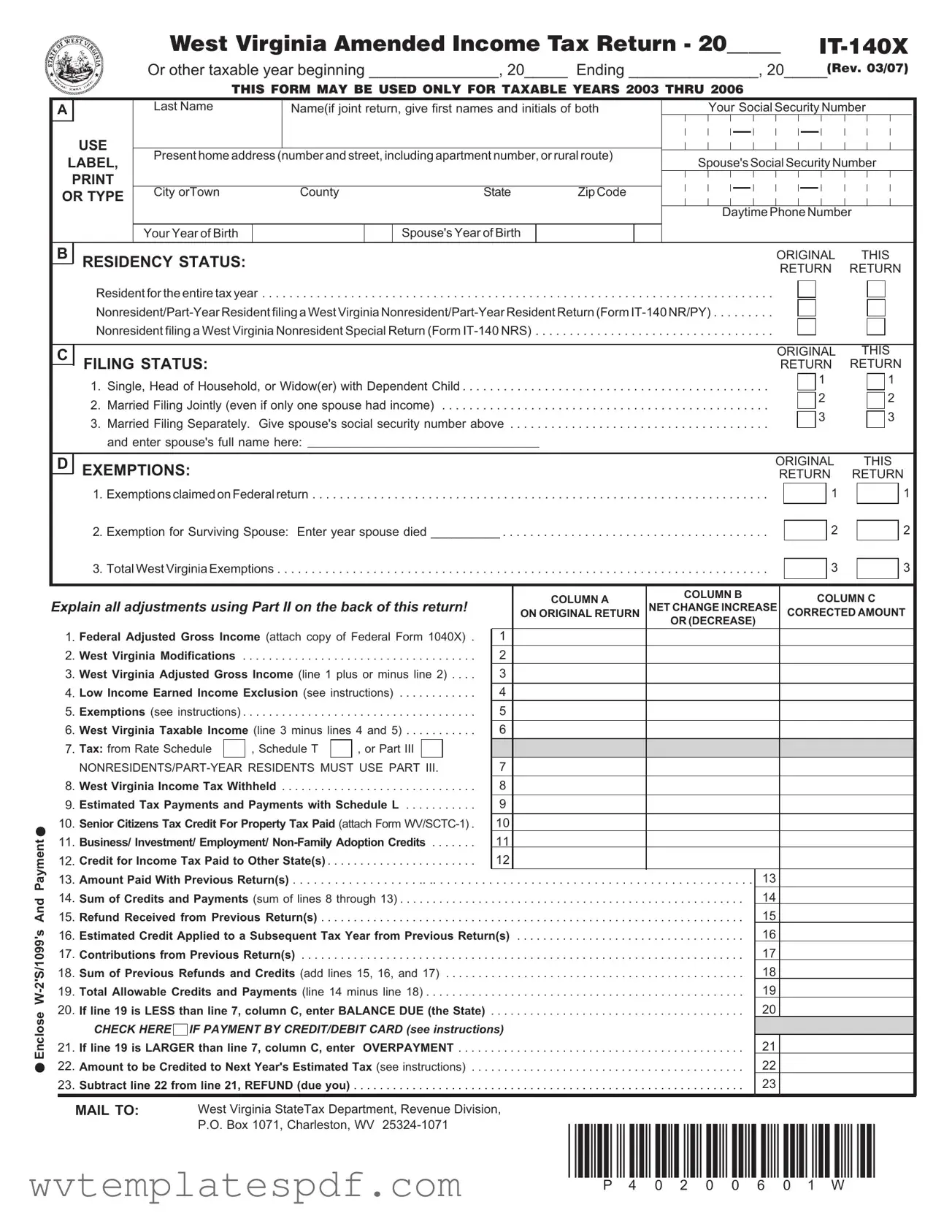

The West Virginia IT-140X form serves as an essential tool for taxpayers who need to amend their previously filed income tax returns for specific tax years. This form is applicable for those who filed their original returns for the years 2003 through 2006. By using the IT-140X, individuals can correct errors in their income, residency status, exemptions, and credits. The form requires taxpayers to provide personal information, including their name, address, and Social Security numbers, as well as details about their filing status, such as whether they are single, married filing jointly, or married filing separately. Taxpayers must also indicate their residency status and report any changes in their federal adjusted gross income. The IT-140X includes sections for detailing adjustments to income and calculating any balance due or refund owed. It is crucial for individuals to follow the instructions carefully to ensure that their amendments are processed correctly and to avoid potential penalties. Overall, the IT-140X is a vital resource for West Virginia residents looking to rectify their tax filings and ensure compliance with state tax regulations.

Other PDF Forms

Wv Circuit Court Forms - The west Virginia Supreme Court is the final arbiter in state appellate matters.

A Power of Attorney (POA) form in Arizona is a legal document that allows one person to appoint another to make decisions on their behalf. This form can cover a wide range of matters, from financial transactions to healthcare decisions. For those seeking guidance, resources such as Arizona PDFs can be invaluable in understanding the nuances of this document and ensuring that their wishes are honored when they can no longer speak for themselves.

West Virginia Police Report - Requests can be faxed, but include a fee of $25 for each crash report sent this way.

Misconceptions

The following list outlines common misconceptions regarding the West Virginia IT-140X form, which is used for amending personal income tax returns. Understanding these misconceptions can help taxpayers navigate the filing process more effectively.

- Misconception 1: The IT-140X form can be used for any tax year.

- Misconception 2: You can file the IT-140X before submitting your original return.

- Misconception 3: All changes to income require a new IT-140X form.

- Misconception 4: Filing jointly means you cannot amend to file separately later.

- Misconception 5: You do not need to attach supporting documents when filing the IT-140X.

- Misconception 6: You can ignore changes made by the IRS to your federal return.

- Misconception 7: The IT-140X form is only for individuals who owe additional taxes.

- Misconception 8: There are no penalties for late filing of the IT-140X.

- Misconception 9: You can file the IT-140X without consulting tax professionals.

This form is specifically designed for taxable years 2003 through 2006 only. Taxpayers must use the appropriate form for other tax years.

The IT-140X can only be filed after the original return has been submitted. It serves as an amendment to correct previously filed information.

Not all changes necessitate a new form. Minor corrections may be addressed in a different manner, depending on the nature of the change.

Taxpayers can amend their filing status from jointly to separately; however, both spouses must file separate returns if making this change.

Supporting documents, such as W-2s or 1099s, must be attached to substantiate any changes made on the amended return.

Taxpayers are legally required to notify the West Virginia State Tax Department of any changes to their federal return within 90 days.

This form is also applicable for those who expect a refund due to overpayments or corrections to their tax situation.

Filing the IT-140X late may result in penalties or interest, similar to late filing of the original return.

While it is not mandatory to consult a tax professional, doing so can provide valuable guidance, especially for complex situations.

West Virginia It 140X: Usage Instruction

Completing the West Virginia IT-140X form requires careful attention to detail. This amended income tax return is necessary if you need to correct your original filing. Below are the steps to guide you through the process of filling out the form accurately.

- Section A: Write your name(s), address, and Social Security number(s) clearly in the designated spaces. Include your year of birth and your spouse's year of birth if filing jointly. Provide a daytime phone number where you can be reached.

- Section B: Indicate your residency status by checking the appropriate box. If you were not a resident for the entire tax year, you will need to use Part III on the back of the form.

- Section C: Select your filing status by checking one box. If you are married and filing separately, enter your spouse's name and Social Security number in Section A.

- Section D: In Block 1, enter the number of exemptions claimed on your federal return. In Block 2, provide the year your spouse passed away if you are claiming an exemption as a surviving spouse. In Block 3, total the exemptions and enter the result.

- Complete lines 1 through 22 as follows:

- Line 1: Enter your Federal Adjusted Gross Income.

- Line 2: List any modifications to your income.

- Line 3: Calculate your West Virginia Adjusted Gross Income by adding or subtracting line 2 from line 1.

- Line 4: If eligible, enter the Low-Income Earned Income Exclusion.

- Line 5: Multiply the number of exemptions in Block 3 by $2,000. If you claimed zero exemptions, enter $500.

- Line 6: Calculate your West Virginia Taxable Income by subtracting lines 4 and 5 from line 3.

- Line 7: Determine your West Virginia Income Tax based on the applicable rate schedule.

- Line 8: Enter the amount of West Virginia tax withheld from your wages.

- Line 9: List total estimated tax payments made during the taxable year.

- Line 10: Enter any allowable Senior Citizen Tax Credit for property tax paid.

- Line 11: If claiming business/investment/employment/non-family adoption credits, enter the total here.

- Line 12: Enter any income tax paid to other states.

- Line 13: List the total amount paid with previous returns.

- Line 14: Sum all credits and payments from lines 8 through 13.

- Line 15: Enter the total refunds received from previous returns.

- Line 16: List any estimated credit applied to the next tax year.

- Line 17: Enter any contributions made with previous returns.

- Line 18: Add lines 15, 16, and 17 for total previous refunds and credits.

- Line 19: Calculate total allowable credits and payments by subtracting line 18 from line 14.

- Line 20: If your tax (line 7) exceeds your total credits (line 19), enter the balance due.

- Line 21: If your total credits exceed your tax, enter the overpayment amount.

- Line 22: Specify any amount to be credited to next year's estimated tax.

- Line 23: Subtract line 22 from line 21 to determine your refund.

- Part III: If you are a nonresident or part-year resident, complete the calculations as directed on the back of the form.

- Sign and date the return. If filing jointly, both spouses must sign.

- Mail the completed form to the West Virginia State Tax Department at the address provided on the form.

Similar forms

The West Virginia IT-140X form is an essential document for taxpayers looking to amend their state income tax returns. It shares similarities with several other tax forms used across the United States. Here’s a look at eight documents that are comparable to the IT-140X, along with an explanation of how they are similar:

- Form 1040X - Amended U.S. Individual Income Tax Return: Like the IT-140X, this form is used by taxpayers to amend their federal income tax returns, allowing them to correct errors or make changes after filing.

- Hold Harmless Agreement: For those engaging in activities where liability may arise, it's essential to use the proper Hold Harmless Agreement documentation to safeguard against potential legal issues.

- Form IT-140 - West Virginia Personal Income Tax Return: The original return upon which the IT-140X is based. The IT-140 is filed to report income, deductions, and credits, while the IT-140X is specifically for amendments.

- Form IT-140NR - West Virginia Nonresident Personal Income Tax Return: This form is similar in that it is used by nonresidents to report income earned in West Virginia. The IT-140X can be used to amend this return as well.

- Form 1040 - U.S. Individual Income Tax Return: This is the primary federal tax return form. Changes to the federal return may necessitate the use of Form 1040X, similar to how changes to the West Virginia return require the IT-140X.

- Form 1045 - Application for Tentative Refund: This form allows taxpayers to apply for a quick refund of taxes due to a net operating loss. Like the IT-140X, it addresses situations where previous returns need adjustment.

- Form 8862 - Information to Claim Certain Refundable Credits After Disallowance: This form is used when claiming credits after they have been disallowed in prior years. It serves a similar purpose of rectifying previous tax filings.

- Form 8888 - Allocation of Refund (Including Savings Bond Purchases): This form allows taxpayers to allocate their tax refund to multiple accounts or purchase savings bonds, similar to how IT-140X allows adjustments for refunds due to amended returns.

- State-Specific Amended Returns: Many states have their own forms for amending income tax returns. These forms, like the IT-140X, are designed for taxpayers to correct or update their tax information after filing the original return.

Understanding these forms can help taxpayers navigate the often complex landscape of tax amendments. Each form serves a specific purpose, but they all share the common goal of ensuring that taxpayers can accurately report their financial situations and receive any refunds they may be owed.

Documents used along the form

When filing your West Virginia IT-140X form, you may find that several other forms and documents are necessary to ensure a complete and accurate submission. Each of these forms serves a specific purpose and can help clarify your tax situation. Below is a list of commonly used forms alongside the IT-140X.

- Form IT-140: This is the original West Virginia Personal Income Tax Return. If you are amending your return with the IT-140X, you should have filed this form first.

- Form IT-140NR/PY: This is used by nonresidents and part-year residents to report their West Virginia income. If your residency status has changed, this form may be relevant.

- Form IT-140NRS: A specific return for nonresidents, this form is for individuals who have income from West Virginia sources but are not residents of the state.

- Form 1040X: The federal amended income tax return. If you amend your federal return, you must also amend your West Virginia return using the IT-140X.

- Schedule M: This schedule is used to report modifications to your federal adjusted gross income. Attach this if you are making changes to your income.

- California ATV Bill of Sale: Don't forget to include the essential California Templates during your transaction for a smooth ownership transfer.

- Schedule T: This is the Alternative Minimum Tax Schedule. If you are subject to federal minimum tax, you will need this to calculate your West Virginia tax.

- Schedule E: This schedule is used to claim a credit for taxes paid to other states. If you are changing this amount, attach a corrected Schedule E.

- Form WV/SCTC-1: This form allows senior citizens to claim a tax credit for property taxes paid. If you qualify, include this form with your IT-140X.

- Schedule L: This is used to report any estimated tax payments made during the year. If you made such payments, they should be included in your amended return.

- Supporting Documents: This includes W-2s, 1099s, and any other relevant documentation that supports the changes you are making on your IT-140X.

Using these forms correctly can help streamline the process of amending your tax return. It is essential to ensure that all relevant documents are attached and that the information provided is accurate. This diligence will help you avoid delays and potential issues with your tax filings.

Common mistakes

Filling out the West Virginia IT-140X form can be a daunting task, and many individuals make common mistakes that can lead to delays or issues with their tax returns. One frequent error occurs when taxpayers fail to provide accurate personal information. It is essential to ensure that names, addresses, and Social Security numbers are correctly entered. Mistakes in this section can result in processing delays or even misdirected refunds.

Another common mistake is related to residency status. Taxpayers often check the wrong box when indicating whether they were residents for the entire tax year. This is critical because it determines which parts of the form must be completed. Nonresidents or part-year residents must use different calculations, and failing to select the correct residency status can complicate the filing process.

Many individuals also overlook the importance of accurately reporting exemptions. Taxpayers may mistakenly enter the wrong number of exemptions claimed on their federal return. If the exemptions do not match, it can lead to incorrect calculations of taxable income. This discrepancy can cause significant issues, especially if the taxpayer is owed a refund.

Inaccurate calculations of federal adjusted gross income (AGI) represent another common pitfall. Taxpayers sometimes fail to attach necessary documentation, such as a copy of the federal Form 1040X, when making changes. This omission can result in the West Virginia tax department being unable to verify the AGI, leading to potential rejections or delays in processing the return.

Moreover, many people neglect to check the appropriate filing status. The IT-140X form has specific instructions for different statuses, including single, married filing jointly, and married filing separately. Choosing the wrong status can affect tax rates and exemptions, ultimately impacting the amount owed or refunded.

Finally, failing to sign the form is a mistake that can prevent the return from being processed. Both spouses must sign a joint return, and if the return is prepared by someone else, that preparer must also sign. This oversight can lead to unnecessary delays in processing the return and receiving any refunds due.

Key takeaways

Filling out and using the West Virginia IT-140X form can be straightforward if you keep a few key points in mind. Here are some essential takeaways:

- Purpose: The IT-140X form is used to amend your West Virginia income tax return. This includes corrections to the original IT-140 or IT-140NR/PY forms.

- Eligibility: You can only use this form for taxable years from 2003 to 2006.

- Filing Deadline: If there are changes to your federal adjusted gross income, you must notify the West Virginia State Tax Department within 90 days.

- Residency Status: Indicate whether you were a resident for the entire year or a nonresident/part-year resident. This affects how you calculate your tax.

- Filing Status: Select your filing status accurately. This includes options like single, married filing jointly, or married filing separately.

- Exemptions: Report the number of exemptions claimed on your federal return. If you are a surviving spouse, you may qualify for an additional exemption.

- Income Adjustments: Clearly explain any changes to your income or exemptions on Part II of the form. Attach supporting documents as needed.

- Calculating Tax: Use the appropriate rate schedule based on your filing status to compute your West Virginia income tax.

- Credits and Payments: Include any credits you are claiming, such as those for taxes paid to other states or senior citizen tax credits.

- Signature Requirement: Ensure that both spouses sign the form if filing jointly. An unsigned return will not be processed.

By following these guidelines, you can effectively complete the IT-140X form and ensure that your amended return is processed smoothly.