Fill a Valid West Virginia Opt 1 Form

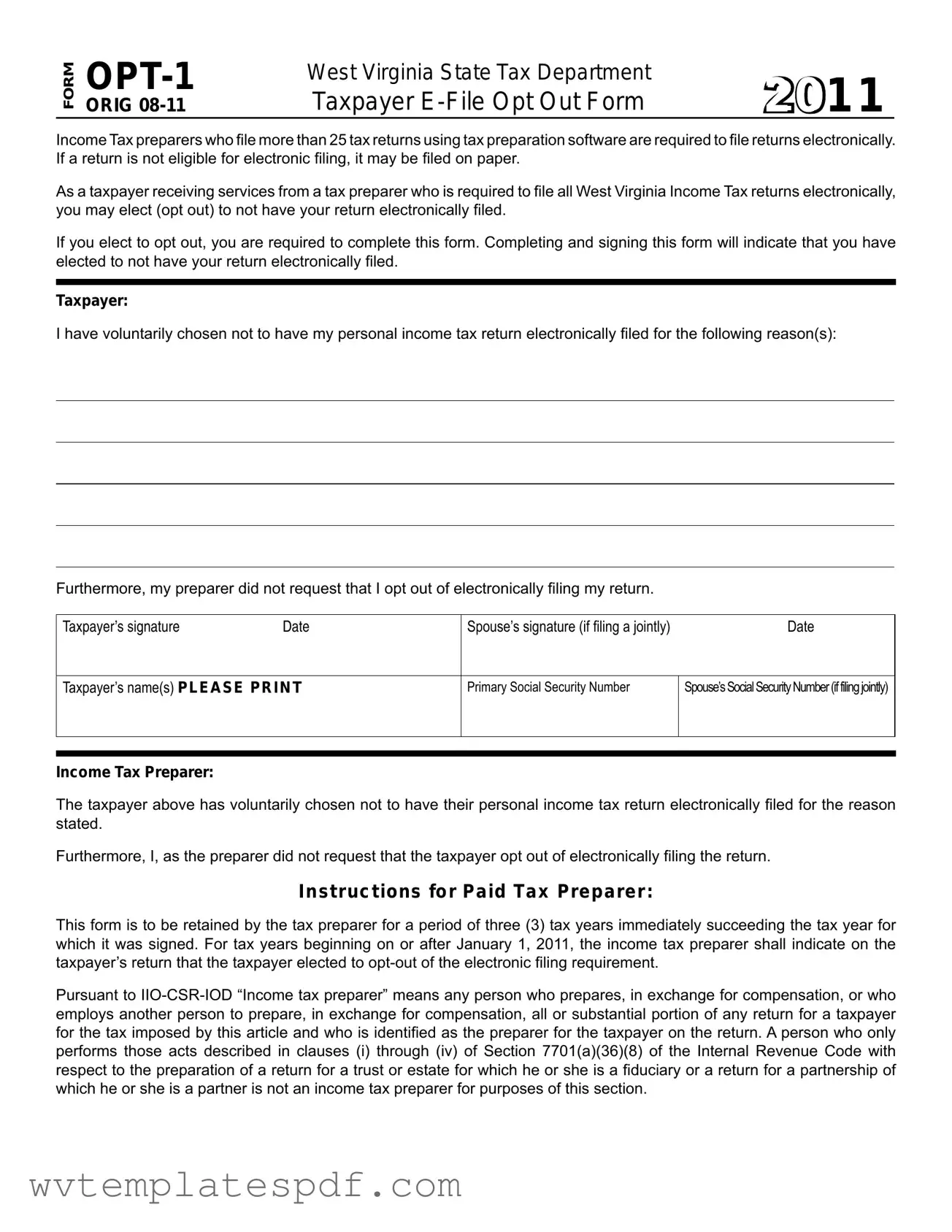

The West Virginia Opt 1 form serves an important role for taxpayers who wish to opt out of electronic filing of their income tax returns. Under state regulations, tax preparers who file more than 25 returns using tax preparation software are mandated to submit those returns electronically. However, taxpayers have the option to decline this electronic filing process. By completing the Opt 1 form, individuals can formally express their decision not to have their returns filed electronically. This choice must be documented with signatures from both the taxpayer and their spouse if they are filing jointly. The form also requires the taxpayer to provide their Social Security numbers and the reason for opting out. The tax preparer is responsible for retaining this form for three years following the tax year it pertains to. Additionally, the preparer must indicate on the taxpayer's return that the opt-out election was made. Understanding the implications of this form can empower taxpayers to make informed decisions about their tax filing methods.

Other PDF Forms

Wv Circuit Court Forms - For each assignment of error, provide a compact statement on why it warrants the court's attention.

Wv Business Registration Certificate - The form differentiates between profit and non-profit organizational structures.

For those looking to safeguard themselves during events, understanding the significance of a Hold Harmless Agreement is essential. This form can help clarify responsibilities and ensure peace of mind. To learn more about this protective measure, visit the detailed Hold Harmless Agreement overview.

West Virginia Police Report - In cases where the incident was investigated by another agency, requests must be made to that specific agency.

Misconceptions

Understanding the West Virginia Opt 1 form can help taxpayers make informed decisions about their tax filing preferences. However, several misconceptions often arise regarding this form. Here are six common misunderstandings:

- 1. The Opt 1 form is mandatory for all taxpayers. Many believe that every taxpayer must complete the Opt 1 form. In reality, this form is only necessary for those who wish to opt out of electronic filing when their tax preparer is required to file electronically.

- 2. Opting out means you cannot file electronically at all. Some think that by opting out, they lose the ability to file electronically entirely. This is not the case. Taxpayers can still file electronically if they choose to do so; opting out simply means they prefer a paper filing for that particular year.

- 3. The form needs to be submitted to the state. There is a misconception that the Opt 1 form must be sent to the West Virginia State Tax Department. Instead, it should be retained by the tax preparer for three years, as it serves as documentation for the choice made by the taxpayer.

- 4. Only the taxpayer needs to sign the form. Some individuals believe that only the taxpayer's signature is required. However, if filing jointly, both spouses must sign the form to indicate their mutual decision to opt out.

- 5. The preparer has the authority to opt out on behalf of the taxpayer. It is a common misunderstanding that tax preparers can decide to opt out for their clients. In fact, the decision to opt out must be made voluntarily by the taxpayer, with the preparer simply documenting that choice.

- 6. The form is only relevant for individual tax returns. Many think the Opt 1 form applies solely to individual tax returns. However, it is relevant for any taxpayer who is required to file electronically, which can include various types of returns depending on the preparer's obligations.

By clarifying these misconceptions, taxpayers can better navigate their options regarding electronic filing and ensure they meet their preferences and requirements effectively.

West Virginia Opt 1: Usage Instruction

After you have decided to opt out of electronic filing for your West Virginia income tax return, you will need to complete the Opt 1 form. This form is a declaration that you have chosen not to have your return filed electronically, and it must be filled out correctly to ensure compliance with state tax regulations. Follow these steps to fill out the form accurately.

- Begin by writing your name in the designated area for the taxpayer's name(s). Make sure to print clearly.

- Enter your Primary Social Security Number in the appropriate field. This is crucial for identifying your tax records.

- If you are filing jointly with a spouse, provide their name and Social Security Number in the respective fields.

- Indicate the reason for opting out of electronic filing in the space provided. Be specific and concise.

- Sign and date the form in the spaces marked for the taxpayer's signature and date. If applicable, your spouse should also sign and date the form.

- If you are using a tax preparer, they need to complete their section. The preparer should confirm that you voluntarily chose to opt out and that they did not request this decision.

- Ensure that the tax preparer signs and dates the form as well.

- Review the completed form for any errors or missing information before submitting it with your tax return.

Once the form is completed and signed, it should be submitted along with your paper tax return. Keep a copy of the form for your records, as it may be required for future reference or audits.

Similar forms

The West Virginia Opt 1 form serves a specific purpose for taxpayers who wish to opt out of electronic filing of their income tax returns. Several other documents share similarities with this form, each catering to different situations regarding tax filing preferences. Below is a list of these documents and their similarities to the West Virginia Opt 1 form:

- IRS Form 8948: This form allows taxpayers to opt out of e-filing when they have certain exceptions, similar to how the West Virginia Opt 1 form provides an option for opting out of electronic filing.

- California ATV Bill of Sale: A crucial document that records the transfer of ownership for ATVs, similar to the options available in the West Virginia Opt 1 form, and can be accessed at California Templates.

- California Form 8453: This document serves as a declaration for taxpayers who choose to file their returns on paper rather than electronically, mirroring the choice presented in the Opt 1 form.

- New York State Form IT-201: This form includes a section where taxpayers can indicate their preference for paper filing, akin to the West Virginia Opt 1 form's opt-out option.

- Florida Form DR-501: This form is used by taxpayers to request a paper return instead of e-filing, reflecting the same intention as the West Virginia Opt 1 form.

- Texas Form 1040: While primarily a federal form, it allows taxpayers to select their filing method, similar to the choice provided by the Opt 1 form.

- Illinois Form IL-1040: This form includes a checkbox for opting out of electronic filing, paralleling the West Virginia Opt 1's process for taxpayers.

- Pennsylvania Form 40: Taxpayers can indicate their preference for paper filing on this form, which aligns with the purpose of the West Virginia Opt 1 form.

- Ohio Form IT 1040: This form allows taxpayers to opt out of e-filing under specific circumstances, similar to the West Virginia Opt 1 form.

- Massachusetts Form 1: Taxpayers can choose to file their state tax returns on paper instead of electronically, reflecting the same principle as the Opt 1 form.

Each of these documents serves to empower taxpayers, providing them with the ability to choose their preferred method of filing. Understanding these forms can help individuals navigate their tax obligations more effectively.

Documents used along the form

The West Virginia Opt 1 form is an important document for taxpayers who wish to opt out of electronic filing of their income tax returns. However, it is often used alongside other forms and documents that help facilitate the tax filing process. Below is a list of some commonly associated documents that may be required or helpful when filing taxes in West Virginia.

- West Virginia Personal Income Tax Return (Form IT-140): This is the primary form used by residents to report their income and calculate their state tax liability. It includes details about income, deductions, and credits.

- Power of Attorney (POA) form: A crucial document that allows one individual to appoint another to handle their affairs, including tax matters. This can be especially important when navigating the complexities of state tax filings, and templates can be found at Arizona PDFs.

- West Virginia Resident Income Tax Return (Form IT-141): This form is specifically for part-year residents or non-residents who have income sourced from West Virginia. It helps determine the appropriate tax owed based on the income earned while residing in the state.

- West Virginia Schedule A (Form IT-140S): This schedule is used to itemize deductions for taxpayers who choose not to take the standard deduction. It allows individuals to list specific expenses that may lower their taxable income.

- West Virginia Schedule B (Form IT-140B): This form is used to report income from various sources, such as interest and dividends. It provides a detailed breakdown of these income types for accurate tax reporting.

- Federal Form 1040: Although not a West Virginia form, this federal tax return is essential for reporting income to the IRS. Many taxpayers also need to reference this form when completing their state returns.

- West Virginia Extension Request (Form IT-140-EXT): If additional time is needed to file a state tax return, this form allows taxpayers to request an extension. It is crucial to submit this before the original due date of the return.

- West Virginia Taxpayer Identification Number (TIN): This number is often required for identification purposes when filing taxes. It can be the taxpayer’s Social Security Number or an Employer Identification Number (EIN).

- West Virginia Tax Preparer's Signature Page: This document serves as a verification that the tax preparer has completed the return and is responsible for the information provided. It may be required alongside the Opt 1 form to confirm the preparer's role.

Understanding these documents can simplify the tax filing process and ensure compliance with state regulations. Each form serves a unique purpose, helping taxpayers accurately report their income and manage their tax obligations in West Virginia.

Common mistakes

Filling out the West Virginia Opt 1 form can be straightforward, but many people make common mistakes that can delay the process or lead to complications. One significant error is failing to provide complete information. Each section of the form requires specific details, such as names and Social Security numbers. Omitting any of this information can result in the form being rejected.

Another mistake is not signing the form. Both the taxpayer and the spouse, if applicable, must sign and date the document. A missing signature can invalidate the opt-out request, forcing the taxpayer to start over. It’s essential to double-check that all required signatures are present before submission.

Some individuals neglect to indicate their reason for opting out. The form includes a section where taxpayers must state their reasons clearly. Skipping this part can lead to confusion and may require additional clarification from the tax preparer.

Using incorrect or outdated information is also a frequent issue. Taxpayers must ensure they are using the most recent version of the Opt 1 form. If an outdated form is submitted, it may not be accepted, causing unnecessary delays.

Another common error is misunderstanding the role of the tax preparer. Taxpayers should remember that the form must be completed and signed by the taxpayer, not the preparer. The preparer’s role is to acknowledge the taxpayer's decision to opt out, not to make that decision on behalf of the taxpayer.

Additionally, some people fail to retain a copy of the completed form. It is crucial for taxpayers to keep a copy for their records, as they may need to reference it in the future. Not having a copy can lead to complications if questions arise later.

Finally, procrastination can be a significant pitfall. Filling out the form at the last minute can lead to rushed mistakes. It’s advisable to complete the form well in advance of any deadlines to ensure all information is accurate and complete.

Key takeaways

Filling out and using the West Virginia Opt 1 form requires careful attention to detail. Here are key takeaways to keep in mind:

- Eligibility: The form is intended for taxpayers whose income tax preparers are required to file returns electronically.

- Voluntary Opt-Out: Taxpayers can choose to opt out of electronic filing by completing this form.

- Signature Requirement: Both the taxpayer and spouse (if filing jointly) must sign the form to validate the opt-out choice.

- Retention of Form: Tax preparers must keep the signed form for three tax years following the year it was signed.

- Reason for Opting Out: Taxpayers should clearly state their reason for opting out on the form.

- Preparer's Role: The tax preparer must confirm that they did not request the taxpayer to opt out of electronic filing.

- Indication on Return: The tax preparer must indicate on the taxpayer’s return that the opt-out choice was made.

- Compliance with Regulations: The form and its use must comply with the relevant state tax regulations.